พุซซี่888 ทางเข้าพุซซี่888 ดาวน์โหลด ทรูวอเลท100% สล็อต ขั้นต่ำ 1 บาท Top 83 by Jeremy รับโบนัสทันที! 6 ก.ย. 2566

Pussy888 พุซซี่888 ความครบถ้วนบริบูรณ์ของการพนันบนโลกโทรศัพท์มือถือ สร้างรายได้เป็นอย่างมาก

Pussy888 พุซซี่888 ความครบถ้วนบริบูรณ์ของการพนันบนโลกโทรศัพท์มือถือ สร้างรายได้เป็นอย่างมาก

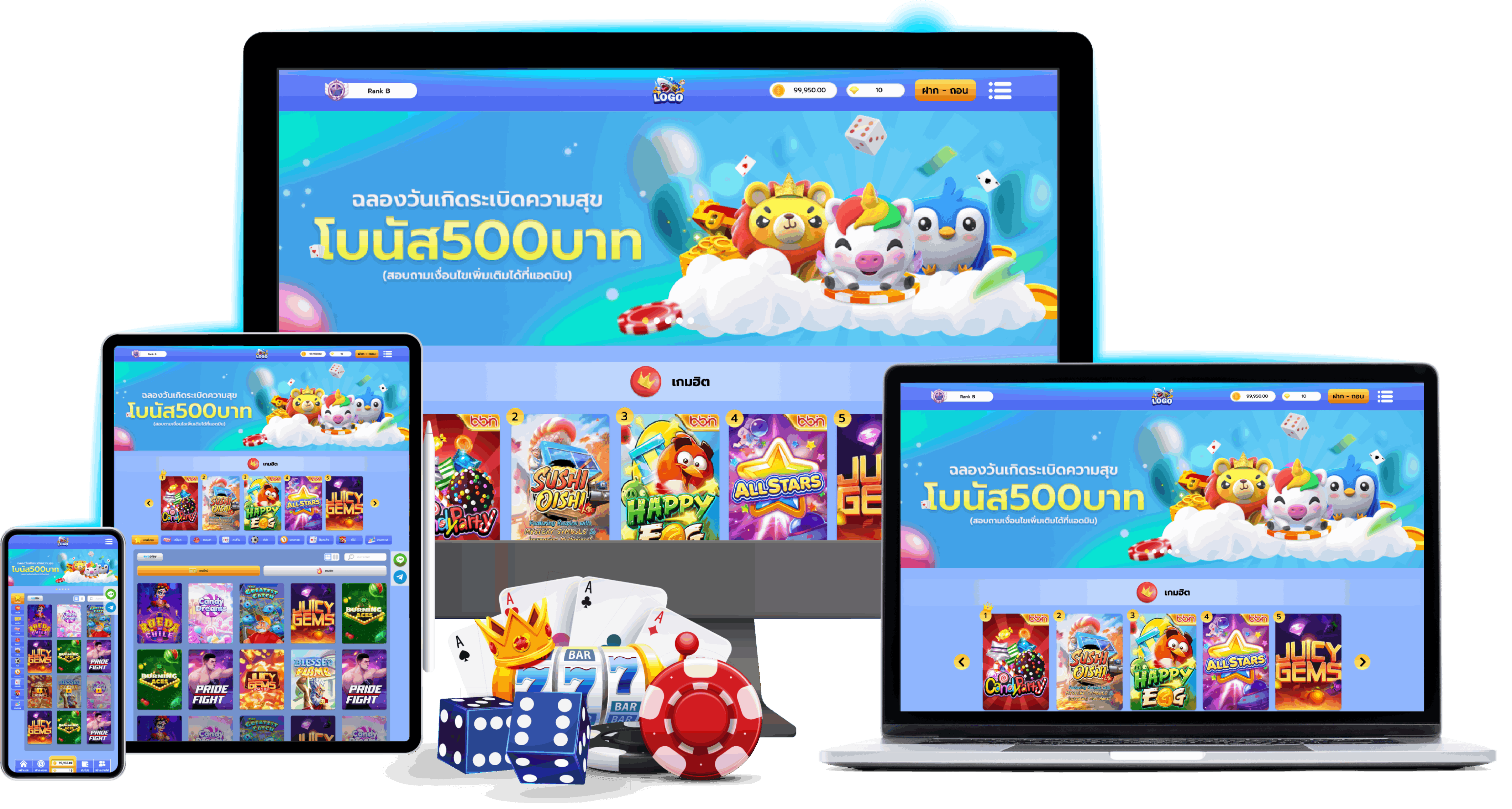

Pussy888 เป็นแพลตฟอร์มคาสิโนออนไลน์ที่พรีเซ็นท์เกมสล็อตที่นานัปการ เป็นที่นิยมในโลกของการพนันออนไลน์เนื่องมาจากอินเทอร์เฟซที่ใช้งานง่าย การเล่นเกมที่น่าดึงดูด แล้วก็ช่องทางที่จะชนะเงินจริง นี่เป็นเรื่องสำคัญบางประการของสล็อตบน Pussy888 pussy888 มีเกมสล็อตให้เลือกมากมายก่ายกอง ตั้งแต่สล็อตสามวงล้อคลาสสิกไปจนกระทั่งสล็อตวิดีโอยุคใหม่ที่มีช่องจ่ายเงินหลายช่อง คุณสมบัติโบนัส รวมทั้งธีม ผู้เล่นสามารถค้นหาเกมที่ตรงกับสิ่งที่จำเป็นของพวกเขา ไม่ว่าพวกเขาจะเพลิดเพลินกับเครื่องผลไม้แบบเริ่มแรกหรือสล็อตรูปแบบใหม่ๆที่ผลิตขึ้นมาเพื่อนักเดิมพันทุกกลุ่ม

เล่นสล็อตเข้าถึงง่ายผ่านมือถือ รองรับวัสดุอุปกรณ์การพนันทุกรุ่น

Pussy888 พุซซี่888 ได้รับการปรับให้เหมาะสมกับการเล่นเกมบนมือถือ ช่วยให้ผู้เล่นเพลินใจไปกับเกมสล็อต ที่ประทับใจบนสมาร์ทโฟนแล้วก็แท็บเล็ต ความสบายสบายนี้ทำให้เป็นตัวเลือกอันดับที่หนึ่งสำหรับผู้เล่นที่ชื่นชอบเกี่ยวกับการเล่นเกมระหว่างเดินทาง เพิ่มประสบการณ์ใหม่ให้กับผู้ใช้แพลตฟอร์ม โดยผู้พัฒนาระบบของพวกเรานี้ให้ความใส่ใจกับประสบการณ์ผู้ใช้ที่ราบระรื่นและก็รื้นเริง รูแบบที่ใช้งานง่ายแล้วก็เพิ่มความสบายสบายสำหรับในการใช้งาน ทำให้ทั้งผู้เล่นมือใหม่รวมทั้งผู้เล่นที่มีประสบการณ์ สามารถเข้าถึงได้ การเข้าถึงเกมเดิมพันได้ง่าย และก็นึกถึงสิ่งที่ดีต่อผู้ใช้นี้มีส่วนทำให้ได้รับความนิยม

โบนัสแล้วก็โปรโมชั่นคุ้มค่า พร้อมมอบให้ลูกค้า พุซซี่888 pussy888

เช่นเดียวกับคาสิโนออนไลน์หลายที่ ที่มีการเสนอโบนัสแล้วก็โปรโมชั่นล้นหลามเพื่อล่อใจรักษาผู้เล่น สิ่งพวกนี้อาจรวมทั้งโบนัสต้อนรับ ฟรีสปิน และรางวัลตอบแทนผู้ใช้งาน ทำให้ผู้เล่นได้โอกาสพิเศษที่จะชนะโดยปกติ พุซซี่888 pussy888 จะให้การช่วยเหลือลูกค้าเพื่อช่วยเหลือผู้เล่นสำหรับเพื่อการสอบถามหรือปัญหาใดๆก็ตามที่พวกเขาบางทีอาจพบขณะเล่นสล็อตหรือใช้แพลตฟอร์ม สิ่งจำเป็นเป็นจะต้องทราบว่าความพร้อมเพรียงใช้งานรวมทั้งคุณสมบัติของพวกเราบางทีอาจเปลี่ยนไปตามยุคสมัย ด้วยเหตุดังกล่าวจึงเสนอแนะให้เยี่ยมชมเว็บอย่างเป็นทางการหรือติดต่อฝ่ายสนับสนุนลูกค้า เพื่อรับข้อมูลปัจจุบันเกี่ยวกับเกมสล็อตและบริการของเรา นอกเหนือจากนี้พวกเรายังพร้อมให้บริการการพนันด้วยคุณภาพ

ความปลอดภัยและการเล่นมีความเที่ยงธรรม

คาสิโนออนไลน์ที่มีชื่อให้ความเอาใจใส่กับความปลอดภัยรวมทั้งการเล่นที่เที่ยงธรรม เราใช้เทคโนโลยีการเข้ารหัสเพื่อคุ้มครองปกป้องข้อมูลของผู้เล่น แล้วก็การันตีว่าเกมสล็อตมีความเที่ยงธรรม โดยไม่มีเรื่องราวคดโกงซึ่งสามารถตรวจตราจากการรีวิว และบอกต่อบรอการจากผู้ใช้งานจริงได้เลย อีกทั้งตัวเลือกการชำระเงินโดยปกติพวกเรามีวิธีการจ่ายเงินที่หลากหลาย สำหรับในการฝากแล้วก็ถอนเงิน รวมทั้งบัตรเครดิต กระเป๋าเงินอิเล็กทรอนิกส์ และการโอนเงินผ่านธนาคาร ความยืดหยุ่นนี้ทำให้ผู้เล่นสามารถจัดการเงินลงทุนของตนเองได้สบาย

เพราะอะไรเกมสล็อต พุซซี่888 ทั้งในระบบทั่วไปแล้วก็ออนไลน์ถึงได้รับความนิยมเป็นอย่างมาก

แน่นอน! ในบริบทของการเล่นเกม โดยทั่วไป สล็อต จะเป็นเกมคาสิโนชนิดหนึ่งที่เรียกว่า

สล็อตออนไลน์ นี่คือประเด็นสำคัญบางประการเกี่ยวกับสล็อตเกมจากค่าย pussy888fun

พื้นฐานของสล็อตออนไลน์ สล็อตออนไลน์เป็นเกมการพนันยอดนิยมที่เจอได้อีกทั้งในคาสิโนทั่วไปและคาสิโนออนไลน์จะมีวงล้อ (ธรรมดาสามวงขึ้นไป) ที่หมุนเมื่อผู้เล่นเปิดใช้งาน

• เครื่องหมายสล็อตออนไลน์ พุซซี่888 มีเครื่องหมายต่างๆบนวงล้อ เป็นต้นว่า ผลไม้ ตัวเลข ตัวเขียน แล้วก็ไอคอนตามธีม ชุดค่าผสมที่ชนะจะเกิดขึ้นเมื่อสัญลักษณ์เฉพาะเรียงกันในลักษณะใดลักษณะหนึ่ง

• ช่องชำระเงิน ช่องจ่ายเงินคือเส้นที่พาดผ่านวงล้อที่สามารถเกิดชุดค่าผสมที่ชนะได้ สล็อตออนไลน์แต่ละเครื่องมีจำนวนช่องชำระเงินที่ต่างกัน ตั้งแต่บรรทัดเดียวไปจนถึงหลักร้อยหรือหลักพัน

• การเดิมพันและการชำระเงินผู้เล่นวางเดิมพันก่อนหมุนวงล้อ แล้วก็จำนวนเงินที่ชนะจะขึ้นกับการรวมกันของสัญลักษณ์เฉพาะที่ปรากฏบนเพย์ไลน์ การชำระเงินอาจต่างกันอย่างมาก โดยบางสล็อตเสนอแจ็คพอตแบบโปรเกรสซีฟที่อาจส่งผลให้กำเนิดความมีชัยครั้งใหญ่

• ธีมและก็ฟีพบร์ สล็อตออนไลน์มีธีมหลากหลาย เช่น อียิปต์โบราณ ตำนาน ภาพยนตร์ แล้วก็อื่นๆอีกมากมาย สล็อตจำนวนไม่น้อยยังมีฟีเจอร์โบนัส อย่างเช่น ฟรีสปิน สัญลักษณ์เสริม รวมทั้งมินิเกมเพื่อทำให้การเล่นเกมน่าตื่นเต้นเพิ่มขึ้น

• ตัวก่อร่างสร้างตัวเลขสุ่ม (RNG) สล็อตออนไลน์ยุคใหม่ใช้เทคโนโลยี RNG เพื่อแน่ใจว่าผลลัพธ์ของการหมุนแต่ละครั้งจะเป็นแบบสุ่มและเป็นกลางทั้งหมดทั้งปวง ซึ่งแสดงว่าการชนะคือเรื่องของโชคเป็นส่วนใหญ่

สล็อตออนไลน์ สล็อต ทางเข้าเล่นเสถียรภาพ ระบบมั่นคง

เกมสล็อตจึงเข้าถึงได้ง่ายเพิ่มขึ้น ผู้เล่นสามารถเพลิดเพลินกับสล็อตที่มากมายได้จากที่บ้านหรือบนเครื่องมือโทรศัพท์เคลื่อนที่ พนันอย่างมีสติสัมปชัญญะ สล็อตออนไลน์ พุซซี่888 เป็นความบันเทิง แต่ว่าก็สามารถเสพติดได้ด้วยเหมือนกัน เป็นสิ่งจำเป็นสำหรับผู้เล่นในการเดิมพันอย่างมีความรับผิดชอบและก็กำหนดวงเงินการใช้จ่ายของพวกเขา สล็อตออนไลน์เป็นเยี่ยมในเกมคาสิโนที่ได้รับความนิยมสูงที่สุดเพราะว่าความธรรมดาและก็มีโอกาสชำระเงินรางวัลเยอะมาก ผู้เล่นหลากหลายประเภทชื่นชอบตั้งแต่นักพนันทั่วไปไปจนกระทั่งนักเดิมพันระดับที่ค่อนข้างสูง โปรดจำไว้ว่าในตอนที่การเล่นสล็อตสามารถเบิกบานแล้วก็สร้างกำไรได้ แต่ว่าก็มีความเสี่ยงในการสูญเสียเงินเช่นเดียวกัน สิ่งจำเป็นคือจำต้องเล่นการพนันอย่างมีมีสติแล้วก็อยู่ในแนวทางระบุของคุณ

การลงพนันเกมสล็อตออนไลน์ pussy888 บนเว็บไซต์นี้ เป็นอีกหนึ่งหนทางวิธีการทำเงินสร้างรายได้ที่บันเทิงใจ และพร้อมแจกโบนัสรางวัล ยินดีต้อนรับนักเดิมพันที่มีทุนน้อย ให้ได้สัมผัสกับเว็บไซต์ตรงไม่ผ่านเอเย่นต์ ที่สามารถเข้าถึงได้ผ่านทางหน้าเว็บ หรือจะติดตั้งแอปพลิเคชันลงบนมือถือก็สามารถทำได้

เกม พุชชี่888 สล็อต มีให้เลือกกว่า 200 เกม พุซซี่888 28 ก.ย. 66 Jeremy คาสิโน พุซซี่888ลงทะเบียนฟรี Top 56

ขอขอบคุณมาก Ref. พุซซี่888

24 ส.ค. 2023 ufa เวปไซต์ufabet เว็บตรง casinoเว็บใหญ่ ยูฟ่า ทดลองเล่น Top 4 by Elliott ufabet ufa007.in

ยูฟ่าเบท มือใหม่ทดลองแทงบอลได้อย่างไม่ยากเย็น

ยูฟ่าเบท มือใหม่ทดลองแทงบอลได้อย่างไม่ยากเย็น

วันนี้เรามาบอกสูตรหรือเทคนิคดีๆที่จะเปลี่ยนแปลงนักพนันมือใหม่ ให้เปลี่ยนเป็นเซียนพนันบอล ยูฟ่าเบท ไปพร้อมด้วยวิธีสำหรับการพินิจพิจารณาบอลคู่เด็ดแบบง่ายๆแล้วก็แม่นที่สุด ผ่านการศึกษาเล่าเรียนสถิติต่างๆที่นักพนันมือใหม่ก็ไม่ได้ทำยาก ลงทุนน้อยหรือมากมาย ก็สามารถได้กำไรได้ ถ้าเกิดพินิจพิจารณาบอลเป็น ยังมีการชิงชัยนานัปการลีก ทำให้นักพนันผู้คนจำนวนมากที่ปรารถนาทำกำไรกับการพนันชนิดนี้ มองหาสูตรแทงบอลให้ได้เงินจริงแน่ๆ

ufabet มือใหม่ทุกคนก็เป็นเซียนบอลได้ ถ้าหากรู้จักสูตรนี้

ที่เว็บufabetเราวันนี้ได้สะสมสูตรแทงบอล ที่ได้รับความนิยมในเหล่านักเล่นพนัน ซึ่งล้วนแล้วแต่เป็นเว็บไซต์ที่สามารถทำเป็นง่าย ไม่ต้องลงทุนมาก เหมาะสำหรับนักเดิมพนัมือใหม่ ที่พึ่งเริ่ม และไม่แน่ใจสำหรับการลงเดิมพันทีละมากมายๆนั่นเอง โดยสูตรยอดนิยมจะเป็นสูตรแทงบอลลำพังหรือบอลเต็ง

ที่เว็บufabetเราวันนี้ได้สะสมสูตรแทงบอล ที่ได้รับความนิยมในเหล่านักเล่นพนัน ซึ่งล้วนแล้วแต่เป็นเว็บไซต์ที่สามารถทำเป็นง่าย ไม่ต้องลงทุนมาก เหมาะสำหรับนักเดิมพนัมือใหม่ ที่พึ่งเริ่ม และไม่แน่ใจสำหรับการลงเดิมพันทีละมากมายๆนั่นเอง โดยสูตรยอดนิยมจะเป็นสูตรแทงบอลลำพังหรือบอลเต็ง

การแทงบอลออนไลน์ ได้รับความนิยมอย่างใหญ่โต ซึ่งการพนันก็มีให้เลือกเล่นนานาประการต้นแบบ ไม่ว่าจะเป็นบอลสูง-ต่ำ บอลคู่-คี่ บอลลำพัง หรือบอลสเต็ป รวมทั้งฯลฯ ซึ่งแต่ละรูปแบบก็จะให้อัตราจ่ายที่ต่างกันออกไป เพื่อตอบสนองในสิ่งที่ต้องการของเหล่านักพนันนั่นเองค่ะ

ufa พนันอย่างไรให้รวยได้จริง

การพนันบอลufabetออนไลน์ ก็ถือเป็นการลงทุนอีกหนึ่งวิถีทาง ที่เอาอกเอาใจนักพนันที่ประทับใจกีฬาบอลอยู่แล้ว โดยทำผลกำไรกับเกมนี้ จะต้องคาดคะเนผลที่จะเกิดขึ้นในอนาคต ผ่านการวิเคราะห์สถิติ หรืออ้างอิงการแข่งขันก่อนหน้านี้ที่ผ่านมา ในตอนนี้ก็เลยมีการสะสมสูตรแทงบอลให้ได้เงิน เพื่อเป็นตัวช่วยทำให้นักเดิมพันสามารถทำเงินกับเกมได้มากขึ้นนะคะ

ยูฟ่าเบท เลือกแทงบอลเว็บไซต์ไหนดี

เลือกเดินพันสล็อตออนไลน์กับเว็บของเรา การันตีการแทงบอลหลายแบบ ไม่ว่าจะเป็นแทงบอลโดดเดี่ยว แทงบอลเต็ง คาสิโนสด และก็ยังมีแนวทางการเล่น การสอนแนวทาง บอกสูตรต่างๆเหมาะสำหรับนักเล่นการพนันมือใหม่ รูปแบบการเล่นไม่ยาก ด้วยเหตุว่าพวกเรามีข้อมูลให้ได้เรียนรู้การแทงบอลต่างๆไว้อย่างประณีตครบถ้วนบริบูรณ์ เล่นเว็บไซต์พวกเราสามารถแทงได้ทุกคนอย่างแน่แท้

ยูฟ่า สูตรพนันบอล สำหรับนักพนันมือใหม่

เป็นสูตรที่สามารถใช้ได้จริงอย่างแน่นอน ทั้งยังสามารถเข้าใจได้ง่าย ไม่สลับซับซ้อน ผ่านการอ้างอิงสูตร พินิจพิจารณาบอล แม่นๆที่สามารถจะช่วยให้นักพนันทำเงินกับการแทงบอลลำพัง หรือบอลเต็งได้ง่ายขึ้นนั่นเอง ซึ่งสูตรของเราได้อ้างอิงจากสถิติย้อนหลัง อัตราการยิง สถิตการเล่นในบ้าน รวมทั้งชั้นตารางคะแนนของแต่ละทีมนั่นเอง

โดยสถิติเหล่านี้สามารถที่จะช่วยให้นักเดิมพันพินิจพิจารณาบอลได้ง่ายขึ้น รวมถึงสามารถเลือกคู่เด็ด และก็การแข่งขันที่เป็นไปได้อย่างมากกว่านั่นเอง นอกจากวิเคราะห์บอลเป็น การเลือกใช้สูตรที่ใช้ได้จริงก็มีผลเหมือนกัน สูตรพนันบอลเดี่ยวที่เราเก็บรวบรวมมามีอะไรบ้างมาดูกันจ้ะ

1. สูตรแทงสูง-ต่ำ เป็นสูตรที่สามารภใช้ได้ทั้งบอลโดดเดี่ยว และก็บอลสเต็ป เนื่องด้วยการแทงแบบสูง-ต่ำ จะเป็นการพนันที่อ้างอิงสกอร์รวม หลังจบการประลองเป็นหลักนั่นเอง ซึ่งนักพนันเพียงแค่ทายว่าสกอร์รวมของคู่การประลอง จะสูงหรือต่ำลงยิ่งกว่าค่าถัวเฉลี่ยที่เว็บระบุแค่นั้น โดยสูตรนี้ ไม่จำเเป็นจำต้องลงทุนอะไรมากมายอีกด้วย

2. สูตรแทงแบบสองโอกาส สูตรนี้เป็นสูตรที่ได้โอกาสชนะสูงมากมาย เพราะว่านักเดิมพันสามารถเลือกได้ 2 โอกาสหรือ 2 ใน 3 โดยการเลือกแทงจะมีเพียงแค่ 3 ผลที่ได้โอกาสเกิดขึ้น นั่นคือ กลุ่มเจ้าของบ้านชนะ กลุ่มเยี่ยมชนะ หรือเสมอ หากทายเจ้าบ้านหรือกลุ่มเยี่ยม พอๆกับว่า ถ้าเกิดมีกลุ่มใดทีมนึงชนะ ก็ได้เงินไปนั่นเอง เป็นแนวทางที่ง่าย มีโอกาสสูงที่จะชนะพนันเลยทีเดียว

3. สูตรแทงสูงด้านหลังเกม การแทงบอลจะสามารถเลือกได้ว่าจะแทงเฉพาะตอนครึ่งแรก หรือแทงแบบเต็มเวลา ทำให้นักเดิมพันสามารถดูโอกาสสำหรับในการทำแต้มของการแข่งขันนี้ได้ โดยสูตรนี้จะให้นักเดิมพันรอเวลาจนถึงตอนใกล้่จบเกม หรือช่วง 25 นาทีสุดท้าย แม้ยังมีสกอร์ หรือได้โอกาสน้อยที่จะทำแต้ม การแทงสูง ก็จะมีโอกาสชนะมากกว่านั่นเอง

ยูฟ่าเบท เพิ่มด้วยแนวทางวิเคราะห์คู่บอล เพิ่มกำไรอีกเท่าตัว

พนันบอลufabetนั่น กระบวนการวิเคราะห์บอลเป็นปัจจัยหลักที่จะทำให้นักเล่นการพนันบอลสามารถเอาชนะการเดิมพันได้ ดังนั้นนักพนันบอลทุกคนจะต้องสามารถพินิจพิจารณาบอลให้ได้ ซึ่งวิธีการวิเคราะห์บอลให้แม่น ประยุกต์ใช้ผลได้จริงมีวิธีการง่ายๆแทงบอลไม่ยากอย่างที่คิดนะคะ

เริ่มจากศึกษาอันดับตารางคะแนน เนื่องจากว่าตารางอันดับคะแนนเป็นสิ่งที่นักเล่นการพนันบอลสามารถเอามาพินิจพิจารณาการแข่งขันชิงชัยได้ และถ้าเกิดพินิจพิจารณาได้ดิบได้ดีคุณจะสามารถคาดเดาได้อย่างแม่นยำว่าทีมไหนได้โอกาสชนะ อาทิเช่น บางคราวมมีคะแนนอยู่ชั้นด้านหลังๆชอบรีบทำคะแนนเพื่อให้ทีมของตัวเองรอด ซึ่งกลุ่มพวกนี้มักจะสามารถทำเกมได้เป็นอย่างดีเลยจ้ะ

เลือกเล่นในบ้าน จากสถิติพวกเราจะมีความเห็นว่าการเล่นในบ้านนั้นได้โอกาสชนะการพนันสูง เพราะเหตุว่าเหนือกว่ามากกว่านั่นเอง แม้กลุ่มในบ้านจะมีฟอร์มการเล่นไม่ดีก่อนหน้าแต่การเล่นในบ้านถือเป็นเรื่องที่ดีมาก เรียนรู้อันดับตารางคะแนน เพราะว่าตารางชั้นคะแนนเป็นสิ่งที่นักเล่นการพนันบอลสามารถนำมาพินิจพิจารณาการแข่งขันชิงชัยได้ และแม้วิเคราะห์เจริญคุณจะสามารถคาดคะเนได้อย่างเที่ยงตรงว่าทีมไหนมีโอกาสชนะ

สล็อตแตกง่าย ยูฟ่าเบท ufa007.in 10 กันยายน 23 Elliott คาสิโนออนไลน์ ยูฟ่าเบทเว็บไหนดี Top 91

ขอขอบคุณ Ref. ยูฟ่าเบท

ต.ค. 2023 สล็อต168 เวปไซต์แจกหนัก คาสิโนออนไลน์เว็บแม่ สล็อตเว็บตรง ทดลองเล่น Top 31 by Elana สล็อต168 m.hengjing168.win 18

hengjing168 เล่น สล็อต สุดเฮง เล่นอย่างไรก็มั่งมี พร้อมตัวช่วยเยอะแยะ

สล็อตเว็บตรง ผ่านเว็บไซต์ที่เปิดให้บริการเกมคาสิโนออนไลน์ ถ้าคุณกำลังลังเลว่าควรที่จะทำการเลือกใช้บริการกับทางเว็บไซต์ของพวกเรา จะต้องบอกเลยว่าเว็บไซต์ของพวกเรามีความน่าสนใจอย่างมาก ทั้งยังในเรื่องของบริการเกมสล็อตออนไลน์ รวมไปถึงโปรโมชั่นพื้นที่เว็บไซต์ของเรามีการเตรียมการไว้ให้ใช้งานกับเกมสล็อต เพราะเหตุว่าตั้งแต่ครั้งแรกที่คุณกระทำการลงทะเบียนสมัครสมาชิก คุณจะได้รับโปรโมชั่นที่เว็บไซต์ของพวกเราตระเตรียมไว้ให้ทันที ด้วยเหตุว่าเว็บของเราต้องการช่วยทำให้นักพนันสามารถอดออมทุน

สล็อตเว็บตรง ผ่านเว็บไซต์ที่เปิดให้บริการเกมคาสิโนออนไลน์ ถ้าคุณกำลังลังเลว่าควรที่จะทำการเลือกใช้บริการกับทางเว็บไซต์ของพวกเรา จะต้องบอกเลยว่าเว็บไซต์ของพวกเรามีความน่าสนใจอย่างมาก ทั้งยังในเรื่องของบริการเกมสล็อตออนไลน์ รวมไปถึงโปรโมชั่นพื้นที่เว็บไซต์ของเรามีการเตรียมการไว้ให้ใช้งานกับเกมสล็อต เพราะเหตุว่าตั้งแต่ครั้งแรกที่คุณกระทำการลงทะเบียนสมัครสมาชิก คุณจะได้รับโปรโมชั่นที่เว็บไซต์ของพวกเราตระเตรียมไว้ให้ทันที ด้วยเหตุว่าเว็บของเราต้องการช่วยทำให้นักพนันสามารถอดออมทุน

เครื่อข่ายล้ำสมัย ใช้งานไม่มีสะดุด นำเข้าเกมสล็อตถูกลิขสิทธิ์แท้

สำหรับในการเข้าร่วมเล่นเกมสล็อตเว็บตรง เราก็เลยมีการจัดสร้างโปรโมชั่นขึ้นมาให้กับสมาชิก ดังนี้นักเดิมพันยังสามารถทดสอบเล่นเกมสล็อตออนไลน์ได้ฟรี โดยการใช้เครดิตฟรีที่เรามีการเตรียมไว้ให้ ถ้าหากคุณต้องการเป็นสมาชิกกับ ทางเข้าเล่นสล็อตออนไลน์เว็บไซต์ตรง สามารถเริ่มต้นด้วยการลงทะเบียนเป็นสมาชิกอย่างราบรื่น โดยการติดต่อกับทางเจ้าหน้าที่ผ่านทางไลน์ออฟฟิเชียล ช่องทางการสมัครผ่านไลน์ที่ทางเว็บไซต์ของเราจะตระเตรียมไว้ให้ คุณจะสามารถติดต่อกับทางเจ้าหน้าที่ได้โดยตรง โดยข้าราชการจะรอซัพพอร์ต เพื่อกระทำลงทะเบียนเป็นสมาชิกให้กับคุณตลอด 1 วัน เพื่อความสบายสบายสำหรับเพื่อการเข้าใช้งานอย่างดีที่สุด

สำหรับในการเข้าร่วมเล่นเกมสล็อตเว็บตรง เราก็เลยมีการจัดสร้างโปรโมชั่นขึ้นมาให้กับสมาชิก ดังนี้นักเดิมพันยังสามารถทดสอบเล่นเกมสล็อตออนไลน์ได้ฟรี โดยการใช้เครดิตฟรีที่เรามีการเตรียมไว้ให้ ถ้าหากคุณต้องการเป็นสมาชิกกับ ทางเข้าเล่นสล็อตออนไลน์เว็บไซต์ตรง สามารถเริ่มต้นด้วยการลงทะเบียนเป็นสมาชิกอย่างราบรื่น โดยการติดต่อกับทางเจ้าหน้าที่ผ่านทางไลน์ออฟฟิเชียล ช่องทางการสมัครผ่านไลน์ที่ทางเว็บไซต์ของเราจะตระเตรียมไว้ให้ คุณจะสามารถติดต่อกับทางเจ้าหน้าที่ได้โดยตรง โดยข้าราชการจะรอซัพพอร์ต เพื่อกระทำลงทะเบียนเป็นสมาชิกให้กับคุณตลอด 1 วัน เพื่อความสบายสบายสำหรับเพื่อการเข้าใช้งานอย่างดีที่สุด

ระบบฝากถอนล้ำยุค มั่นใจฝากเบิกเงินง่ายเงินเข้ากระเป๋าโดยทันที

ในเว็บไซต์ของเรา มีอีกหนึ่งความน่าสนใจ เป็นระบบฝากถอนที่มีความทันสมัย โดยทางเว็บไซต์ของเรามีการเปิดระบบการฝากถอน ซึ่งสามารถทำรายการได้ด้วยตนเอง เป็นระบบฝากเงิน อัตโนมัติ คือระบบที่สามารถสำรวจได้ ทั้งยังในเรื่องของการฝากถอนโอนเงิน หรือวิธีการทำธุรกรรมในด้านการคลังทุกชนิด ซึ่งไม่ยุ่งยากต่อการใช้งานเป็นอย่างมาก โดยนักพนันสามารถ ทำรายการฝากถอนโอนเงินและร่วมเป็นส่วนหนึ่งกับทางเว็บไซต์ของพวกเราได้ผ่านทาง หน้าเว็บหลักของพวกเราโดยตรง การันตีว่าจะช่วยให้คุณสามารถเข้าถึงการ เล่นเกมสล็อต168ได้อย่างมีประสิทธิภาพเยอะขึ้น โดยการใช้เว็บไซต์ของพวกเราเป็นตัวกลาง

ทุนน้อยก็มั่งมีได้ เล่นสล็อตออนไลน์พร้อมโปรโมชั่นสุดพิเศษ

ในเว็บไซต์นี้มีการตระเตรียมโปรโมชั่นสำหรับสมาชิก เพื่อให้นักเดิมพันที่มีทุนน้อยได้สามารถเข้าร่วมเป็นส่วนหนึ่งกับทางเว็บไซต์ของเรา อย่างที่พวกเรากล่าวไว้ว่านักเดิมพันที่ลงทะเบียนเป็นสมาชิกเข้ามาใช้บริการกับทางเว็บของพวกเรานั้น จะสามารถรับโปรโมชั่นเครดิตฟรีได้โดยทันที โดยโปรโมชั่นที่เราตระเตรียมไว้ให้นั้นสามารถใช้งานได้กับการลงเดิมพันเกมสล็อตเว็บตรงทุกเกม จะใช้งานผ่านระบบทดลองเล่นหรือจะใช้เพื่อลงพนันแทนเงินลงทุนของคุณก็สามารถ ใช้งานได้สิ่งเดียวกัน ไม่เพียงแต่ในครั้งแรกที่คุณกระทำสมัครเป็นสมาชิกเข้ามา เพราะทางเว็บของเรามีการเตรียม โปรโมชั่นเครดิตฟรี ไว้ให้ท่านอยู่ตลอดการใช้แรงงาน ร่วมกันกับสล็อตออนไลน์แตกง่าย

มือใหม่ต้องการทำเงินเป็นแสน ลักษณ์เว็บสล็อตที่ควรจะใช้งาน

สำหรับในวันนี้ จะมาเสนอแนะรูปแบบของเว็บไซต์สล็อต ที่นักพนันมือใหม่ควรเลือกทำเงิน เพื่อนักเดิมพันที่อยากใช้งาน เกมการเดิมพันสล็อตออนไลน์ที่สามารถได้กำไรได้เป็นแสน สล็อต168 พร้อมแบ่งปันรูปแบบของเว็บที่มีคุณภาพ เสมอเหมือนเว็บไซต์ของเราเป็นอย่างไร

• การฝากเบิกเงินที่ทำรายการได้ด้วยตัวเองบนระบบ AUTO

• แจกโปรโมชั่นใช้แทนเงินสดได้ไม่อั้น

• ทดสอบเล่นสล็อตออนไลน์ได้ ฟรีไม่มีจำกัด

• แนะนำเกมแตกจากค่ายยอดนิยม ในระยะเวลาโบนัส

• มีคณะทำงานคอยเตรียมพร้อมดูแลนักพนันตลอดการใช้งาน

• แจ้งข้อมูลข่าวสารเพื่อไม่ให้พลาดสิทธิประโยชน์

• เกมเยอะแยะเลือกเล่นได้จุใจ

จะมองเห็นได้ว่าบริการกลุ่มนี้ เป็นลักษณะ ของเว็บไซต์ที่นักเดิมพันมือใหม่ควรจะใช้งาน ทั้งยังนักพนันควรจะมองรีวิว มีการบอกต่อจากผู้ใช้งาน ซึ่งลักษณะของเว็บไซต์แห่งนี้ เป็นเว็บที่มอบสิทธิประโยชน์ และพร้อมการให้บริการเหนือระดับ ทำให้นักเดิมพันสามารถ ทำเงินง่ายแม้ว่าคุณจะเป็นมือใหม่ เพราะเรานึกถึง นักพนันที่เลือกใช้บริการกับเว็บไซต์แห่งนี้ โดยเหตุนั้นถ้าเกิดอยากใช้บริการ เว็บดีมีคุณภาพสามารถสมัครเป็นสมาชิกเข้าใช้งานกับพวกเราได้เลย

ลงพนันไม่มีจำกัด สมัครรับไม่อั้น ลงเดิมพันไม่มีขั้นต่ำ

อีกหนึ่งสิ่งที่ทำให้เว็บไซต์ของพวกเรา นับว่าเป็นเว็บที่การเดิมพันซึ่งสามารถ ยั่วยวนใจผู้ใช้งานได้แบบไม่มีตก ชื่อเว็บของเราเป็นบริการ ลงพนันแบบไม่มีจำกัด สามารถเริ่มลงพนันได้ด้วยอัตราการลงเดิมพัน 1 บาท แม้กระนั้นอัตราการชำระเงินรางวัลที่สูงที่สุด รวมถึงโปรโมชั่นที่ทางเว็บไซต์ของเรามอบให้ ยังช่วยทำให้นักพนันสามารถทำเงินง่าย ทำให้นักพนันที่กำลังมองหา เว็บไซต์ที่ประทับใจเพื่อใช้งาน หันมาใช้บริการกับทางเว็บไซต์นี้เยอะมากๆ เพราะเหตุว่าพวกเราเป็นบริการ สล็อตเว็บตรงเว็บไซต์ตรง เว็บที่มีเครือข่ายของการพนันสูงที่สุด พวกเรานำเข้าเกมการพนันคาสิโนออนไลน์ทุกจำพวก พร้อมทั้งคัดสรรเกมการเดิมพันสล็อตออนไลน์จากค่ายที่ได้รับความนิยม ที่ทดสอบมาแล้วว่าเป็นเกมแตกง่ายได้เงินจริง ซึ่งพร้อมทำกำไรให้กับนักเดิมพัน

แม้ว่าเราจะเปิดให้ใช้บริการเว็บนี้ขึ้นมาไม่นาน แม้กระนั้นโครงข่ายของเว็บซึ่งสามารถ ให้บริการด้วยประสิทธิภาพตั้งแต่เปิดให้ใช้งานจนถึงปัจจุบัน ยืนยันได้ว่าเว็บของเราเป็นเว็บไซต์ ที่เปิดให้ใช้งานอย่างเต็มใจ จึงทำให้มีนักพนันมากหน้าหลายตาลงทะเบียนเป็นสมาชิกเข้ามาใช้งาน เมื่อได้รับกำไรจากทางเว็บของพวกเรา และเชื้อเชิญเพื่อนพ้องเข้ามาใช้งาน คุณก็จะได้รับสิทธิประโยชน์ จากการร่วมกิจกรรม ทำให้เว็บของพวกเราเป็นเว็บไซต์ที่มี ผู้ใช้งานมากขึ้นจำนวนไม่ใช่น้อยภายในช่วงเวลาไม่นานนั่นเอง

เว็บตรงสล็อต สล็อต168 m.hengjing168.win 6 November 2566 Elana คาสิโน สล็อต168แตกง่าย Top 18

https://bit.ly/hengjing168-win

https://rebrand.ly/hengjing168-win

ดาวน์โหลด918kiss 918VIP.co 27 ธ.ค. 65 918kiss android เว็บใหญ่ สล็อตเว็บตรงเว็บตรง 918kiss เข้าสู่ระบบ ใหม่ล่าสุด Top 89 by Josef

ชักชวนเพื่อนพ้องฝาก 100 จาก สมัคร918kiss

ชักชวนเพื่อนพ้องฝาก 100 จาก สมัคร918kiss

สวัสดีขอรับชาว 918VIP ทุกท่าน เซฟปากทางเข้า 918kiss download กันรึยังขอรับ? เดี๋ยวนี้ทางค่ายอินเตอร์เน็ตหลายๆค่าย ไม่ว่า

สวัสดีขอรับชาว 918VIP ทุกท่าน เซฟปากทางเข้า 918kiss download กันรึยังขอรับ? เดี๋ยวนี้ทางค่ายอินเตอร์เน็ตหลายๆค่าย ไม่ว่า

จะเป็นทรู ดีแทค หรือเอไอเอส ต่างก็เริ่มแบน URL กันค่อนข้างจะมากครับ ทำให้หลายๆท่านเข้าใช้งานเว็บมิได้ ซึ่งผมก็ไม่แน่ใจว่า 918VIP โดนรึยัง? ฮ่า… ด้วยเหตุผลดังกล่าว กันไว้ดียิ่งกว่าแก้ขอรับ ก็อย่าลืมเซฟปากทางเข้า 918Kiss กันด้วยครับผม สำหรับคนใดที่รีวิวเกม 918kiss จากผมอยู่ ก็รอคอยกันก่อนครับผม

สำหรับบทความในวันนี้ เป็นโปรโมชั่นที่เหมาะสมกับคนเพื่อนฝูงมากมายหรืออินฟลูฯทั้งหลายเลยล่ะขอรับ นั่นก็เพราะ โปรโมชั่นนี้ง่ายแสนง่าย แค่คุณชักชวนสหายมาเล่นกับ 918VIP แค่นั้น คุณก็รับเครดิตฟรีๆไปเลย โดยที่คุณไม่ต้องเติมเงิน

สักบาทด้วยซ้ำ มันจะเกินปุยมุ้ย เอาล่ะนะครับ โปรโมชั่นนี้จะคืออะไร มาดูไปพร้อมๆกับผมเลยจ้ะนะครับ เลทโก!

1. โปรโมชั่น เชื้อเชิญเพื่อนฝูงฝาก 100

สำหรับโปรโมชั่น ชวนเพื่อนพ้องฝาก 100 เป็นโปรโมชั่นที่ดิน 918VIP ทำมาเพื่อเอาอกเอาใจคนสหายมากมายแบบผมเลยล่ะครับ

ซึ่งโปรโมชั่นนี้ เราไม่ต้องฝากเงินเลยแม้กระทั้งบาทเดียว แค่เพียงคุณชวนเพื่อนพ้องมาเล่น สล็อต918kiss รวมทั้งสหายของคุณฝากเงินอย่างต่ำ 100 บาทแล้วก็กดรับโปรสมาชิกใหม่ คุณคนชวนก็รับไปเลยนะครับ 50 บาทฟรี! รวมทั้งที่สำคัญนะครับ ชวนเยอะแค่ไหนก็ได้ไม่จำกัด

คุณมีเพื่อนพ้องสัก 100 คน คุณจะได้จากทาง 918VIP คนละ 50 บาท 100 คน ก็รับไปเลยสิครับ 5,000 บาทจุกๆแล้วอย่างนี้

จะช้าอยู่ใยล่ะนะครับ ไปชวนเพื่อนพ้องมาเร็ว!

แม้กระนั้นช้าก่อนครับ มันมีเงื่อนไขเล็กๆให้ใคร่ครวญนิดนึงนะครับ คุณจำเป็นต้องทำยอด 3 เท่าครับผม ถึงจะสามารถ

ถอนได้ 1 เท่า มีความหมายว่า ถ้าหากได้รับเงิน 50 บาทแล้ว ก็จะต้องทำยอด 150 บาทให้ได้ ถึงจะถอน 50 บาทได้นั่นเองครับ

2. ให้แต้มกันหน่อย

สำหรับคะแนนความคุ้มราคาของโปรโมชั่นนี้ ผมให้ไปเลย 10/10 ขอรับ ด้วยเหตุว่าผมแทบจะไม่ต้องทำอะไรเลยนอกเหนือจากเชิญชวนเพื่อนฝูงมาเล่น ซึ่งเพื่อนพ้องๆของผมคนจำนวนไม่น้อยก็เป็นลูกค้าเว็บอื่นอยู่แล้ว ผมก็แค่เชิญชวนสหายๆมาทาง 918kiss ที่มีโปรโมชั่น

ที่ดีกว่า เกมมากกว่า เสถียรกว่า รวมทั้งที่สำคัญ สล็อตเว็บตรง! แค่ผมขายไปแบบนี้ เพื่อนพ้องผมก็มาแล้วขอรับ แม้ว่าจะจะต้องทำยอด 3 เท่า แม้กระนั้นอย่างที่บอกไปขอรับ เรามิได้เสียเงินเสียทองเลยสักบาท ฮ่า… ด้วยเหตุนั้น ไม่มีเหตุผลอะไรเลยที่ผมจะไม่ให้ 10/10 กับโปรโมชั่นนี้

3. โปรโมชั่นดี พี่จะรับป้ะ?

ในเมื่อผมกด 10/10 ไปแล้ว ผมก็จำต้องรับสิครับผม ฮ่า… ผมตั้งเป้าไว้แล้วครับผมว่า ผมจะเชื้อเชิญเพื่อนพ้องให้ได้สัก 100 คน

เพื่อมารับเงินฟรีๆจาก 918kiss android ให้ได้เลยครับผม ถึงแม้ว่าการทำยอด 3 เท่าจะดูยาก แต่ว่าเชื่อเถอะครับผม มันไม่ได้ยากขนาดนั้น แล้วก็ในเมื่อเงินที่กำลังจะได้ เป็นเงินทุนที่เราไม่ได้ลงทุนเลยสักบาท แบบงี้ก็ไม่สมควรพลาดใช่ไหมล่ะครับผม

และผมขอรับรองอีกรอบเลยคะครับผมว่า รับแน่นอนครับ!

เป็นอย่างไรกันบ้างขอรับกับ เชิญชวนสหายนฝาก 100 จาก ทางเข้า 918kiss หากเป็นคุณจะรับไหมล่ะครับผม? ฮ่า… ผมรู้ๆกันอยู่นะครับว่า หลายท่านอาจจะมองว่ามันไม่คุ้มตรงที่จะต้องทำยอด 3 เท่า แต่อย่างที่ผมบอกไป มันเป็นเงินลงทุนที่คุณไม่ต้องลงทุนเลย

เป็นอย่างไรกันบ้างขอรับกับ เชิญชวนสหายนฝาก 100 จาก ทางเข้า 918kiss หากเป็นคุณจะรับไหมล่ะครับผม? ฮ่า… ผมรู้ๆกันอยู่นะครับว่า หลายท่านอาจจะมองว่ามันไม่คุ้มตรงที่จะต้องทำยอด 3 เท่า แต่อย่างที่ผมบอกไป มันเป็นเงินลงทุนที่คุณไม่ต้องลงทุนเลย

สักบาท ในความคิดของผม มันก็เสมือนผมไม่ได้เสียอะไรเลย ด้วยเหตุนี้ ผมก็เลยมองว่า มันก็เป็นอีกโปรโมชั่นที่ค่อนข้างจะคุ้มและน่าดึงดูดมากมายๆครับ แล้วก็ก่อนจากกันไปวันนี้ ทุกคนอย่าลืมเซฟ โหลด918kissล่าสุด จากทางพวกเราไว้ด้วยนะครับ สำหรับวันนี้

ผมก็จำต้องขอตัวลาไปก่อน แล้วพบกันใหม่ในบทความหน้าครับ สวัสดีครับผม

สล็อตเว็บแม่ 918kiss เข้าสู่ระบบ 918vip.co 1 ธ.ค. 2565 Josef คาสิโนออนไลน์ ทางเข้า 918kissแตกง่าย Top 57

ขอขอบคุณ โหลด918kissล่าสุด Ref. โหลด918kissล่าสุด

Puss888 เข้าสู่ระบบ 20 ธันวา 22 พุซซี่888 เว็บแจกหนัก casinoเว็บแม่ พุซซี่888 ใหม่ล่าสุด Top 70 by Mohamed

Pussy888 โปรดีขนาดนี้ ไม่เล่นไม่ได้แล้ว

สวัสดีครับผมชาว pussy888fun.bet ทุกท่าน เป็นไงบ้างนะครับ ผลประกอบการสล็อตออนไลน์ของทุกคนยังอยู่

สวัสดีครับผมชาว pussy888fun.bet ทุกท่าน เป็นไงบ้างนะครับ ผลประกอบการสล็อตออนไลน์ของทุกคนยังอยู่

ในเกณฑ์ดีใช่ไหมครับ? ถ้าผู้ใดกันแน่เข้าขั้นดีอยู่แล้ว ก็ขอให้ดียิ่งขึ้นเรื่อยนะครับ ส่วนคนไหนกันแน่ที่ยังไม่เข้าเกณฑ์ ก็ขอให้ดีขึ้นนะครับ ผมก็ทรงๆทรุดๆเลย สงสัยจำต้องเข้าแวดวงสีเสื้อมงคลแล้วล่ะครับผม ฮ่า…

บางครั้งอาจจะไม่ต้องเข้าแวดวงสีเสื้อมงคลก็ได้นะครับ เพราะในช่วงเวลานี้ pussy888fun.bet ของพวกเรากำลังจะมีโปรโมชั่นที่น่าดึงดูดมากไม่น้อยเลยทีเดียวเยอะแยะ ยิ่งถ้าคุณเป็นแฟนของค่ายเกมพุซซี่888 แล้วล่ะก็… คุณจะไม่ต้องไปหาเว็บไซต์อื่นเล่นอีกเลยครับผม ทำไมน่ะเหรอขอรับ? ค่ายเกมที่ชอบก็มี แถมจัดโปรโมชั่นดีๆตลอดขนาดนี้ มันก็ไม่ต้องไปไหนกันแล้วล่ะครับ มาจบตรงนี้กันได้เลย ฮ่า…

สำหรับบทความในวันนี้ pussy888 ผมก็จะพาทุกท่านมาดูกันนะครับว่า puss888 เข้าสู่ระบบ นั้นมีโปรโมชั่นอะไรบ้าง น่าดึงดูดแค่ไหน คุ้มหรือเปล่า แล้วโปรโมชั่นไหนเหมาะกับคนใดกันแน่บ้าง มาดูกันเลยขอรับ เลทโก!

1. สมาชิกใหม่ พุซซี่888 รับ 50%

1. สมาชิกใหม่ พุซซี่888 รับ 50%

มาเริ่มกันที่โปรโมชั่นแรก พุซซี่888 กันเลยครับกับ สมาชิกใหม่รับ 50% สำหรับผู้ใดกันที่ยังไม่เคยเป็นพวกกับทางพวกเราก็สามารถลงทะเบียนสมัครสมาชิกแล้วก็มารับโปรโมชั่นนี้ได้เลยครับผม ฝากขั้นต่ำเพียงแค่ 1 บาทเท่านั้น รับโบนัส 50% สูงสุด 500 บาทเลยครับผม ซึ่งถ้าคุณฝาก 1,000 บาท คุณก็จะได้รับโบนัสสูงสุด 500 บาทไปเลยนั่นเองครับผม เรียกว่าเพิ่มทุนให้สมาชิกใหม่กันแบบหนักๆไปเลย โดยโปรโมชั่นนี้มีเงื่อนไขว่า ควรต้องทำยอด 3 เท่า ถึงจะถอนได้สูงสุด 100 เท่านะครับ นั่นหมายความว่า ถ้าคุณฝาก 1,000 บาท รับโบนัสอีก 500 บาท เป็น 1,500 บาท คุณก็ต้องทำยอดให้ได้ 4,500 บาทนั่นเองนะครับ ถึงจะสามารถเบิกเงินทั้งหมดทั้งปวงได้

สำหรับโปรโมชั่นนี้ ก็เหมาะกับทุกท่านที่ยังไม่เคยเป็นพวกกับพุซซี่888 นี่แหละขอรับ เพราะทางพวกเราจะแจกโปรโมชั่นนี้แค่ครั้งแรกครั้งเดียวนะครับผม อย่าลืมมาเป็นพวกกับพุชชี่888ครับ

2. ทุกยอดฝาก 5%

สำหรับโปรโมชั่น ทุกยอดฝาก 5% ก็คือ ไม่ว่าคุณจะฝากมากแค่ไหน คุณก็จะได้รับโบนัสเพิ่มอีก 5% สูงสุด 1,000 บาท แถมทุกยอดฝาก 300 บาทก็ยังได้รับ 10 Candy ไว้หมุนวงล้อได้อีก เรียกว่าคุ้มหลายต่อเลยครับผม โดยโปรโมชั่นนี้มีเงื่อนไขว่า คุณจำเป็นจะต้องทำยอด 2 เท่า ถึงจะถอนได้สูงสุด 100 เท่านะครับ แปลว่า ถ้าหากคุณฝาก 1,000 บาท รับโบนัสอีก 50 บาท เป็น 1,050 บาท คุณก็จำต้องทำยอดให้ได้ 2,100 บาท ถึงจะสามารถถอนเงินทั้งปวงได้

สำหรับโปรโมชั่นนี้ ก็เหมาะสมกับทุกท่านเลยครับผม เพราะเหตุว่าสามารถยอมรับได้ตลอด ไม่ว่าจะหน้าเก่าหน้าใหม่ก็มารับกันได้ครับ

3. Cash Back 10%

โปรโมชั่น Cash Back 10% ก็คือ ไม่ว่าคุณจะเล่น puss888 เข้าสู่ระบบ เสียเท่าไรก็ตาม ก็จะคืนยอดเสียให้คุณ 10% สูงสุดถึง 10,000 บาทเลยครับผม ซึ่งโปรโมชั่นนี้ไม่มีเงื่อนไขครับผม ไม่ต้องทำยอดอะไรก็ตามสามารถถอนได้เลย สามารถยอมรับได้วันละ

1 ครั้ง แถมทุกๆผู้กระทำดรับ Cash Back 100 บาทยังได้รับ 10 Candy ด้วยขอรับ เรียกว่าเป็นโปรโมชั่นปลอบโยนลูกค้าทุกท่านเลยก็ว่าได้

สำหรับโปรโมชั่นนี้ บางคนก็บางครั้งอาจจะไม่รับครับ โดยส่วนตัวแล้ว ผมมองว่าก็เหมาะสมกับท่านที่ต้องการกันเหนียวเผื่อเสียครับผม อย่างถ้าเกิดท่านลงทุน 1,000 บาทแล้วกดรับโปรโมชั่นนี้ ถ้าท่านเล่นเสีย ทาง pussy888 ก็พร้อมจะคืนยอดเสียให้แก่คุณ 100 บาทในทันที แถมยังได้รับ 10 Candy อีกด้วยนะครับ ผมว่าคุ้มมากมายครับผม!

4. สะสม 50 Candy

สำหรับโปรโมชั่นสะสม 50 Candy ก็คือ ทุกๆ50 Candy คุณสามารถนำมาหมุนวงล้อเสี่ยงโชคได้ 1 ครั้ง ในกงล้อ

จะมีทั้งยังทอง 1 สลึง รวมทั้ง เงินสด ให้ท่านได้ลุ้นกัน ซึ่งการรับ Candy ก็หาได้ง่ายๆเลยครับผม คุณจะได้มาจาก การกดรับ Cash Back ทุก 100 บาท รับ 10 Candy, ทุกยอดฝาก 300 บาท (แบบรับโบนัส) รับ 10 Candy, ฝากสม่ำเสมอ 3 วัน 300 บาทขึ้นไป (แบบรับโบนัส) รับ 20 Candy รวมทั้ง Login ทุกชั่วโมง รับ 1 Candy ครับ

5. Happy Birthday for puss888 เข้าสู่ระบบ you

สำหรับโปรโมชั่น Happy Birthday for you ทาง pussy888fun.bet ก็แจกเครดิตฟรีให้ทุกท่านในวันเกิด 300 บาทเลยครับผม ผู้ใดกันไม่มาอำนวยพรวันเกิดท่าน ทางเราให้พรเองนะครับ ฮ่า… โดยโปรโมชั่นนี้มีเงื่อนไขว่า คุณจำเป็นต้องทำยอด 4 เท่า ถึงจะถอนได้ 300 บาท มีความหมายว่า คุณต้องทำยอดให้ 1,200 บาทนั่นเองครับผม ถึงจะถอน 300 บาทที่ดินพวกเราให้ไปได้ ซึ่งโปรโมชั่นนี้จะยอมรับได้แค่เฉพาะในวันเกิดแค่นั้นนะครับ พอถึงวันเกิดแล้วหลังจากนั้นก็อย่าลืมไปรับนะครับ

6. เพียงแค่เชื้อเชิญเพื่อนฝูงก็รวย

สำหรับโปรโมชั่น แค่เชิญชวนเพื่อนฝูงก็รวย มีเงื่อนไขง่ายๆไม่สลับซับซ้อนว่า แค่เพียงคุณเชื้อเชิญสหายฝาก 100 บาทขึ้นไป

พร้อมรับโปรสมาชิกใหม่ puss888 เข้าสู่ระบบ คุณก็รับไปเลยนะครับ 50 Candy เอาไปหมุนกงล้อเสี่ยงดวงได้เลย 1 รอบ โดยคุณจะชักชวนสหายกี่คนก็ได้ hungry purry 888 มิได้จำกัดเลยนะครับ ยิ่งคุณชวนเพื่อนฝูงได้มากมากแค่ไหน คุณก็มีสิทธิ์ลุ้นรางวัลจากวงล้อเพิ่มมากขึ้นเพียงแค่นั้นครับผม

เป็นอย่างไรกันบ้างนะครับกับ โปรโมชั่นต่างๆของทาง พุซซี่888 อย่างที่ผมบอกไป ใครกันแน่ที่เป็นแฟนค่ายเกมพุชชี่888 ไม่ต้องลังเลแล้วครับ เว็บไซต์ของเรารองรับความต้องการของคุณได้แน่นอน รวมทั้งในบทความหน้า ผมจะมาเล่าอะไรให้คุณฟังอีก ก็คอยติดตามกันด้วยนะครับ สำหรับวันนี้ ผมต้องขอตัวลาไปก่อน แล้วเจอกันใหม่ในบทความหน้า

สวัสดีขอรับ

pussy888 puss888 เข้าสู่ระบบ https://pussy888fun.bet 30 Dec 65 Mohamed casino online puss888 เข้าสู่ระบบที่ฮิตที่สุด Top 40

ขอขอบพระคุณเว็บ puss888 เข้าสู่ระบบ

Xoslot webslotxo ฟรีเครดิต พนันออนไลน์เว็บใหญ่ slot auto ใหม่ล่าสุด Top 72 by Booker สล็อตออโต้ slotxoauto.com 24 กุมภา 23

โปรโมชั่นสุดปังจาก slotxoauto.com

สวัสดีขอรับชาว xoslot ทุกท่าน เป็นอย่างไรกันบ้าง อาทิตย์ที่สองของปี 2023 แล้ว ผลประกอบการสล็อตxo

ยังโอเคกันอยู่นะครับ? ผมกับเพื่อนรักของผมในเดี๋ยวนี้คือดำเนินงานกันหนักมากๆสำหรับการหาเกม xoslot ใหม่ๆมารีทิวทัศน์ให้ทุกคน

ได้อ่านกัน เพราะเหตุว่ามีหลายคนเลยครับที่นึกถึงการอ่านรีวิวเกมสล็อตออโต้จากผม ฮ่า… รอคอยกันอีกอึดใจนึงครับ กำลังทดสอบเล่น slot auto กันหลายเกมมากๆรีวิวเกมจะมาแบบจุใจแน่นอนครับ!

สำหรับบทความในวันนี้ ผมจะต้องบอกก่อนว่า ในระหว่างที่ผมก็หาเกม slotxo auto เล่นไปด้วย เพื่อนรักของผมก็ไปตรวจเว็บสล็อตออโต้เว็บไซต์อื่นๆด้วย โดยยิ่งไปกว่านั้นเว็บไซต์สล็อตxoเปิดใหม่ทั้งหลายแหล่เพื่อมองว่า ตอนนี้มีอะไรเปลี่ยนไปบ้างรึเปล่า ซึ่งสหายผมก็กลับมาบอกว่า ต้องการให้ผมได้ทดลองเขียนถึงโปรโมชั่นแล้วก็กิจกรรมของเว็บไซต์ slotxo auto ของเราบ้าง เนื่องจากว่าผมยังไม่เคยเขียนเลย ทุกคนที่เข้ามาอ่านจะได้เข้าใจโปรโมชั่นหรือกิจกรรม รวมทั้งข้อตกลงสำหรับในการเข้าร่วมด้วย ผมก็โอเค นี่ก็เลยเป็นต้นเหตุของบทความในวันนี้นั่นเองขอรับ

เอาละขอรับ เพื่อไม่ให้เป็นการเสียเวลาครับ วันนี้ผมจะขอมาชี้แจงโปรโมชั่นดีๆจาก slot auto กันขอรับว่า ทาง slot auto ของเรานั้นมีโปรโมชั่นอะไรบ้าง เงื่อนไขเป็นยังไง แล้วคนไหนกันสามารถยอมรับได้บ้าง ถ้าหากทุกคนพร้อมแล้ว ก็เลทโกเลยครับ

1. โปรโมชั่น สมาชิกใหม่ รับโบนัส 50%

สำหรับโปรโมชั่น สมาชิกใหม่ รับโบนัส 50% เป็นอีกหนึ่งโปรโมชั่นดีๆจากสล็อตxo ของพวกเราที่ตั้งหัวใจจะมอบให้กับสมาชิกใหม่ทุกๆคนเลยครับผม ซึ่งโปรโมชั่นสำหรับสมาชิกใหม่นั้นถือได้ว่าโปรโมชั่นพื้นฐานของทุกๆเว็บไซต์ slotxo ไปแล้ว เรียกว่าเป็นโปรโมชั่นเรียกลูกค้าใหม่เลยก็ว่าได้ ซึ่งผมก็ไม่เคยรู้นะครับว่าเว็บไซต์ xoslot อื่นๆนั้นให้คุณเท่าใด แต่พวกเราให้โบนัสคุณมากถึง 50% เลยจ๊าครับผม โดยโปรโมชั่นนี้มีเงื่อนไขว่า ถ้าหากคุณสมัครสมาชิกใหม่กับทางเรา ฝากเงินหนแรกและก็รับโปรโมชั่นนี้ คุณก็จะได้รับโบนัสฟรีอีก 50% ของยอดเงินที่ฝากไปเลยขอรับ รับได้สูงสุด 500 บาท แต่คุณจึงควรทำยอดให้ได้ 3 เท่าครับ ถึงจะสามารถถอนเงินออกไปได้

เป็นต้นว่า ถ้าหากคุณลงทะเบียนสมัครสมาชิกใหม่และก็ฝากเงินทีแรก 100 slotxo บาท คุณจะได้รับโบนัสฟรีอีก 50% หรือก็คือ 100 บาท รวมเป็น 200 บาท คุณจำเป็นจะต้องทำยอดให้ได้ 3 เท่า หรือก็คือ 600 บาท ถึงจะสามารถถอนได้นั่นเองนะครับ

หรือหากคุณสมัครเป็นสมาชิกใหม่และฝากเงินหนแรก 500 บาท คุณจะได้รับโบนัสฟรีอีก 50% หรือก็คือ 500 บาท ซึ่งถือเป็นโบนัสสูงสุดของโปรโมชั่นนี้ รวมเป็น 1,000 บาท คุณจำเป็นต้องทำยอดให้ได้ 3 เท่า หรือก็คือ 3,000 บาท ถึงจะสามารถถอนได้นั่นเองครับผม

2. โปรโมชั่น ทุกยอดฝาก รับโบนัส 10%

สำหรับโปรโมชั่น ทุกยอดฝาก รับโบนัส 10% ก็เป็นอีกโปรโมชั่นดีๆที่ไม่ว่าคุณจะเป็นลูกค้าเก่าหรือลูกค้าใหม่ของ slotxo auto ก็สามารถรับโปรโมชั่นนี้ได้ทุกคนเลยขอรับ ซึ่งทาง สล็อตxo ของเราก็มอบโบนัสให้คุณ 10% สูงสุดถึง 5,000 บาท

เลยจ๊าครับ เรียกว่า ยิ่งฝากมากแค่ไหน ก็ยิ่งได้โบนัสจากทางพวกเรามากนะครับ คุ้มๆจุกๆกันไปเลย โดยโปรโมชั่นนี้มีเงื่อนไขว่า เพียงแค่คุณฝากเงินเข้ามา คุณก็มารับโบนัสฟรีอีก 10% ของยอดเงินที่ฝากไปเลยครับผม รับได้สูงสุดถึง 5,000 บาท แต่ว่าคุณจำเป็นจะต้องทำยอดให้ได้ 2 เท่า ถึงจะสามารถถอนเงินออกไปได้ครับผม

ตัวอย่างเช่น ถ้าหากคุณฝากเงินและรับโปรโมชั่นนี้ 100 บาท คุณจะได้รับโบนัสฟรีอีก 10% หรือก็คือ 10 บาท รวมเป็น 110 บาท คุณต้องทำยอดให้ได้ 2 เท่า หรือก็คือ 220 ถึงจะสามารถถอนได้นั่นเองนะครับ

หรือหากคุณฝากเงินรวมทั้งรับโปรโมชั่นนี้ 1,000 บาท คุณจะได้รับโบนัสฟรีอีก 10% หรือก็คือ 100 บาท รวมเป็น 1,100 บาท คุณจึงควรทำยอดให้ได้ 2 เท่า หรือก็คือ 2,200 บาท ถึงจะสามารถถอนได้นั่นเองครับผม

หรือถ้าเกิดคุณปรารถนารับโบนัสสูงสุด คุณจำเป็นจะต้องฝากเงินรวมทั้งรับโปรโมชั่นนี้ 50,000 บาท คุณจะได้รับโบนัสฟรีอีก 10% หรือก็คือ 5,000 บาทนั่นเองครับ รวมเป็น 55,000 บาท คุณจะต้องทำยอดให้ได้ 2 เท่า หรือก็คือ 110,000 บาท ถึงจะสามารถถอนได้นั่นเองนะครับ

3. โปรโมชั่น Cash Back 2%

สำหรับโปรโมชั่นอย่าง Cash Back 2% ก็เป็นอีกโปรโมชั่นที่ slotxo auto จัดไว้เป็นโปรโมชั่นหลักๆที่ไม่ว่าลูกค้าเก่าหรือลูกค้าใหม่ก็สามารถมารับกันได้เลยนะครับ เรียกว่าเป็นโปรโมชั่นสำหรับปลอบโยนในวันที่พวกเราเล่นสล็อตเสียนั่นแหละครับผม โดยโปรโมชั่นนี้มีเงื่อนไขว่า ถ้าหากคุณฝากเงินและรับโปรโมชั่นนี้ หลังจากนั้นคุณไปเล่นสล็อตแล้วเล่นเสีย คุณสามารถมารับเครดิตคืนจากทางเราได้เลย 2% ครับผม สามารถรับได้ไม่อั้น กดยอมรับได้วันละ 1 ครั้งเพียงแค่นั้น

ดังเช่นว่า ถ้าเกิดคุณฝากเงินและรับโปรโมชั่นนี้ 1,000 บาท หากคุณเล่นสล็อตเสีย คุณสามารถมารับเครดิตคืนจากโปรโมชั่นนี้ 2% ได้เลยครับ หรือก็คือ 20 บาทนั่นเอง ซึ่งคุณสามารถยอมรับได้โดยทันที ไม่จำกัดจำนวนเงิน แต่ว่าจะกดรับได้วันละ 1 ครั้งเพียงแค่นั้นนะครับ

เป็นไงบ้างครับผมกับ โปรโมชั่นสุดปังจาก slotxoauto.com ผมบอกเลยว่า เว้นแต่ xoslot ของพวกเรานั้นไม่แพ้เว็บไหนๆในเรื่องของเกมสล็อตออโต้แล้ว เรื่องของโปรโมชั่นเราก็ไม่แพ้คนใดกันแน่เหมือนกันครับผม คนใดกันที่พึงพอใจอยากลองเล่นสล็อตออโต้ล่ะก็ รำลึกถึงพวกเรา สล็อตxo ครับผม สำหรับวันนี้ ผมต้องขอตัวลาไปก่อน แล้วเจอกันใหม่ในบทความหน้า สวัสดีครับ

สล็อตเว็บแม่ xoslot https://slotxoauto.com 26 March 2023 Booker casino slotxoแจกบ่อย Top 10

ขอขอบคุณมากอ้างอิง slotxo

Top 24 by Lucie https://m.slotxo24hr.co ทางเข้าเล่น slotxo เม.ย. 66 slotxo เว็บสล็อตตรงไม่ผ่านเอเย่นต์Slot เว็บสล็อตแตกง่ายสล็อตเครดิตฟรี 1 เว็บสล็อตเว็บตรง สล็อต24

Slotxo24hr สล็อตxoเว็บตรง ทางเข้า slotxo ที่มาแรงที่สุดในปัจจุบัน ไม่มีเว็บไซต์ไหนเสมอกันเว็บของเรา ทางเข้า slotxo ที่สุดโต่งมากมายๆเนื่องจากว่า เราได้กระทำเปิดเว็บ slotxo24hr มาเป็นเวลาอย่างนาน อีกทั้งในและก็เมืองนอก แล้วก็ได้รับการช่วยสนับสนุนเงินทุนมหาศาลจากเหล่านักลงทุนที่พึงพอใจในตัวเรา เพราะฉะนั้น slotxo ของเรานั้น ก็เลยเป็นที่หนดีเยี่ยมที่สุดที่เหมาะกับการเล่น slotxo เราทีมงาน slotxo24hr กระหยิ่มใจพรีเซนเทชั่นเป็นอย่างยิ่ง เพราะว่าเราได้กระทำการสมัครสมาชิกกับกลุ่มคาสิโนโลก และซื้อ License ที่ได้รับการตรวจตรามาตรฐานแล้วว่าเป็น สล็อต24 เว็บไซต์ตรง ที่ตามมาตรฐานระดับที่ค่อนข้างสูงจากการวัดของเหล่าคณะทำงานของหน่วยงานนั้นๆอย่างแท้จริง พวกเรา slotxo24hr จึงเป็นทางเข้า สล็อตxo ที่ดีที่สุดและมีคุณภาพที่สุดของโลก ถ้าเกิดทุกท่านต้องการจะเล่น xoslot จำเป็นที่จะต้องคิดถึงเราแค่นั้น แตกจริงจ่ายจริง แตกหนัก โปรโมชันสุดคุ้ม โปรโมชันดีๆมากมายที่นำเข้าจากคาสิโนสดของ slotxo อย่างแท้จริง ด้วยเหตุผลดังกล่าว รีบเลยครับจารย์ ลงมากจ่ายเยอะ แตกหนักกันอีกทั้งวี่ตลอดทั้งวัน ไม่เชื่อจำต้องทดลอง slotxo24hr ทางเข้า สล็อต24 ที่มาแรงมที่สุดในตอนนี้ ทั้งในและก็ต่างแดน ไม่เชื่ออย่าดูถูกเหยียดหยาม มาจัดกันดูกร แล้วจะรู้ดีว่า การเล่นสล็อตxo กับพวกเรานั้น มันจะแตกหนักขนาดไหน มั่งคั่งงานรวยไว รับทรัพย์สินกันมันส์ๆจะมีที่แหน่งใดอีก นอกเหนือจากที่นี่ slotxo24hr สล็อตxo ที่เยี่ยมที่สุดในโลก ฝ่าเลย จะมัวเสียเวลาอยู่เพื่ออะไร กองเงินกองทองวางกองรออยู่เบื้องหน้าแล้ว รีบคว้าเอาไว้ก่อนจะสายเหลือเกิน sloxo ลู่ทางที่ดีที่สุดสำหรับสาย xoslot เปิดให้บริการแล้ววันนี้ ไม่รีบลุยนี่โคตรพลาดบอกเลย แอดลองแล้ว แบบไม่เข้าข้าง กล่าวกันตรงๆว่าของจริง!

Slotxo เป็นอย่างไร ไหนผู้ใดรู้ยกมือขึ้น!? สล็อตxoเว็บตรง

Slotxo เป็นแพลตฟอร์มคาสิโนออนไลน์ที่มีเกมสล็อตมากไม่น้อยเลยทีเดียวให้ผู้เล่นได้เพลิดเพลินเจริญใจ ” Max win ” หมายถึงจำนวนเงินสูงสุดที่ผู้เล่นสามารถชนะจากการเล่นเกม สล็อตxo เฉพาะบนแพลตฟอร์ม Slotxo ปริมาณ Max win จะต่างๆนาๆในแต่ละเกม และชอบแสดงในหน้าข้อมูลของเกม เพื่อเพิ่มจังหวะสำหรับการแตก Max win สิ่งสำคัญคือจำต้องรู้เรื่องเพย์ไลน์ สัญลักษณ์ รวมทั้งฟีเจอร์โบนัสของเกม สิ่งสำคัญเป็นจำต้องพนันจำนวนเงินสูงสุดที่อนุญาต เพราะว่าจะเพิ่มการจ่ายเงินที่เป็นได้รวมทั้งสิ่งที่จำเป็นที่สุดคือเป็นจำต้องจดจำไว้ว่าในระหว่างที่การเล่นสล็อตออนไลน์บางทีอาจเป็นประสบการณ์ที่รื้นเริงและก็น่าเร้าใจ แต่ก็เป็นแบบอย่างหนึ่งของการเดิมพันด้วย ผู้เล่นควรจะระบุงบประมาณสำหรับในการเล่นเกมของตนเสมอและยึดมั่นกับมัน ตลอดจนทำความเคยชินกับกฎของเกมและก็เปอร์เซ็นต์การชำระเงิน สล็อต24

โดยสรุปแล้ว การได้ Max win บน Slotxo อาจเป็นประสบการณ์ที่น่าตื่นเต้นและคุ้มสำหรับผู้เล่น ด้วยวิธีการทำความเข้าใจเกมและพนันจำนวนเงินสูงสุด ผู้เล่นสามารถเพิ่มช่องทางในการ Max win อย่างไรก็ตาม สิ่งสำคัญเป็นจะต้องเล่นการเดิมพันอย่างมีความรับผิดชอบและอยู่ในงบประมาณเสมอ

การเล่นสล็อตออนไลน์บางทีอาจเป็นประสบการณ์ที่สนุกและน่าตื่นตาตื่นใจ แต่การชนะอาจเป็นเรื่องที่ท้าทายบางส่วน อย่างไรก็ดี มีกลเม็ดรวมทั้งยุทธวิธีบางสิ่งที่คุณสามารถใช้เพื่อเพิ่มจังหวะสำหรับเพื่อการชนะบนแพลตฟอร์ม Slotxo ของพวกเรา เพราะเหตุใดแล้วก็อย่างไรบ้าง ไปดูกัน!

การเล่นสล็อตออนไลน์บางทีอาจเป็นประสบการณ์ที่สนุกและน่าตื่นตาตื่นใจ แต่การชนะอาจเป็นเรื่องที่ท้าทายบางส่วน อย่างไรก็ดี มีกลเม็ดรวมทั้งยุทธวิธีบางสิ่งที่คุณสามารถใช้เพื่อเพิ่มจังหวะสำหรับเพื่อการชนะบนแพลตฟอร์ม Slotxo ของพวกเรา เพราะเหตุใดแล้วก็อย่างไรบ้าง ไปดูกัน!

1. ทำความรู้จักดีกับเกมเสียก่อน : ก่อนที่จะคุณจะเริ่มเล่น สิ่งจำเป็นคือต้องรู้เรื่องกฎของเกม ช่องชำระเงิน เครื่องหมาย และก็รูปแบบของโบนัส สิ่งนี้จะช่วยให้คุณตัดสินใจได้อย่างชาญฉลาดเกี่ยวกับการพนันของคุณ และเพิ่มจังหวะสำหรับในการชนะให้สูงปรี๊ดกับสล็อตxo ทางเข้าxo

2. เดิมพันจำนวนเงินสูงสุด: สล็อตxo ออนไลน์จำนวนมากมีพนันสูงสุดซึ่งสามารถเพิ่มการชำระเงินที่เป็นไปได้ของคุณ หากคุณต้องการชนะสูงสุด จำเป็นมากที่จะจะต้องเดิมพันจำนวนเงินสูงสุดเพื่อรับทรัพหนักสำหรับการหมุนคราวถัดมานะจ๊ะ

3. ใช้ประโยชน์จากโบนัส : Slotxo มอบโบนัสล้นหลามให้กับผู้เล่น รวมทั้งฟรีสปินแล้วก็โบนัสเงินออม ใช้ประโยชน์จากข้อเสนอแนะพวกนี้เพื่อเพิ่มโอกาสสำหรับเพื่อการชนะมากขึ้นไปอีก สล็อต24

4. จัดแจงงบประมาณของคุณให้เรียบร้อย : การตั้งงบสำหรับการเล่นเกม สล็อตxo เป็นเรื่องจำเป็น เพราะจะช่วยทำให้คุณหลีกเลี่ยงการใช้จ่ายเยอะเกินไปและสูญเสียเงินมากกว่าที่คุณสามารถจ่ายได้ ตั้งมั่นในงบประมาณของคุณรวมทั้งอย่าไล่หลังการเสียที่เสียไป มิเช่นนั้นประเดี๋ยวหมดตูด! ทางเข้าเล่น slotxo

5. เล่นเกมที่มีเปอร์เซ็นต์การจ่ายเงินสูงไว้ก่อน : บางเกมบนแพลตฟอร์ม Slotxo มีเปอร์เซ็นต์การจ่ายเงินที่สูงกว่าเกมอื่นๆมองหาเกมที่มีเปอร์เซ็นต์ผลตอบแทนต่อผู้เล่นสูง และเล่นเกมกลุ่มนี้เพื่อเพิ่มจังหวะสำหรับการชนะ หรือพูดง่ายๆว่าเลือกเกมป้อมปราการหัวใจและค่ายที่มเชื่อมั่น ซึ่งควรจะเป็น slotxo แน่ๆแค่นั้น!

6. พักบ้าง อย่าฝืน! : สล็อตxoเว็บตรง สิ่งสำคัญเป็นต้องพักจากการเล่นเพื่อหลีกเลี่ยงการลุ่มหลงกับ สล็อต24 มากเกินไป สิ่งนี้จะช่วยทำให้คุณมีสมาธิแล้วก็ตกลงใจก้าวหน้าขึ้นเกี่ยวกับการพนันของคุณในคราวต่อไป ทางเข้าxo

7. เล่นเพื่อความสนุกก็พอเพียงจ้า : สิ่งที่สำคัญที่สุดที่จำต้องจดจำไว้คือการเล่นเพื่อความสนุก สล็อตออนไลน์เป็นแบบหนึ่งของความบันเทิง และก็การชนะไม่สมควรเป็นเพียงเหตุผลเดียวสำหรับเพื่อการเล่นเกมนะจ๊ะ

โดยสรุป การชนะบน Slotxo บางทีอาจเกิดเรื่องที่ท้า แต่ถ้าเกิดปฏิบัติตามเทคนิคและก็อุบายกลุ่มนี้ ทุกคนจะสามารถเพิ่มจังหวะสำหรับเพื่อการชนะได้ อย่าลืมเล่นอย่างมีความรับผิดชอบแล้วก็อยู่ในงบประมาณอย่าให้แย่ลงกว่าเดิม รวมทั้งสนุกไปกับ สล็อตxo ของพวกเราขณะเล่น ถ้าไม่แตกหรือแตกยากหรือเท่าทุน ให้ทุกคนคิดอะไรเสมอว่า การพนันมีความเสี่ยง แตกถ้าชนะท่านจะร่ำรวยเหมือนเป็นเศรษฐีใหม่ แม้กระนั้นหากแพ้ก็คือเสียทุนเพียงแค่นั้น การเล่นสล็อตออนไลน์กับ slotxo ไม่ใช่ว่าจะแตกเมื่อใดก็ตามทุกท่านเล่น จำเป็นต้องเล่นสล็อตกันอย่างมีสติสัมปชัญญะน้า แม้กระทั่งเว็บดีแค่ไหน ถ้าหากไม่ทราบเพียงพอหรือรู้จักการตั้งลิมิตให้กับตัวเอง ถึงแม้ว่าจะพวกเรา slotxo24hr เป็นผู้แทน slotxo ที่แตกหนักที่สุดก็มีได้มีเสียเหมือนกันจ้า สล็อตxoเว็บตรง

เว็บสล็อต ทางเข้าxo M.slotxo24hr.co 5 มีนาคม 23 Lucie เว็บสล็อตตรงไม่ผ่านเอเย่นต์ สล็อตxoสล็อต xo เวอร์ชั่นใหม่ Top 37

ขอขอบพระคุณby สล็อตxoเว็บตรง

ขอขอบพระคุณby สล็อตxoเว็บตรง

https://rebrand.ly/m-slotxo24hr

มีนาคม 2023 สล็อตออโต้ websiteตรง คาสิโนเว็บเปิดใหม่ สล็อตxo ทดลองเล่น Top 52 by Mose สล็อตออโต้ https://slotxoauto.com 29

ทำไมจะต้องเล่นสล็อตที่ slotxoauto.com

สวัสดีครับผมชาว สล็อตออโต้ ทุกท่าน เริ่มต้นสัปดาห์ที่ 2 ของปี 2023 กันแล้ว ผมหวังว่าทุกคนจะยังแฮปปี้ครับผม ถึงแม้เราจะกลับมาเรียนหรือดำเนินงานกันแล้ว ฮ่า… ในช่วงนี้สิ่งที่ผมดูได้เลยก็คือ เว็บสล็อตxo เปิดใหม่มากไม่น้อยเลยทีเดียวเลยขอรับ ธรรมดาแล้วตอนปลายปีหรือปีใหม่นั้น จะเป็นช่วงที่ xoslot หลายๆเจ้ารีแบรนด์หรือเปิดเว็บใหม่กันอยู่แล้ว เนื่องจากว่าถือว่าเป็นการเริ่ม

ที่ดีนั่นเองครับผม แต่ว่าเชื่อไหมขอรับว่า 2023 นี้ ผมมั่นอกมั่นใจมากมายว่า slot auto เปิดใหม่เยอะกว่าทุกๆปีแน่นอน ฮ่า… ซึ่งนั่นก็ทำให้

พวกเรา slotxo auto จำเป็นต้องทำการบ้านหนักขึ้น พยายามปรับปรุงแล้วก็ปรับปรุงแก้ไขเว็บอยู่เสมอ เพื่อที่ทุกคนจะได้ไม่ไปไหนอย่างไรล่ะครับผม

สำหรับบทความในวันนี้ ก็เกิดขึ้นจากความรู้สึกของผมรวมทั้งทาง สล็อตxo นี่แหละนะครับ เราอยากที่จะให้ทุกๆคนยังคงเล่นสล็อตออโต้กับทางเราอยู่ ไม่ต้องการให้ย้ายเว็บไซต์ไปเล่น xoslot ที่ใด โดยเหตุนี้ พวกเราเลยจะงัดข้อดีและคุณลักษณะเด่นของพวกเราออกมาเพื่อ

ทุกๆคนเห็นกันเลยว่า ขณะนี้ คุณกำลังเป็นพวกของเว็บไซต์ slot auto ชั้น 1 อยู่ และไม่มีความสำคัญต้องย้ายเว็บเลยขอรับ! ส่วนผู้ใดกันแน่ที่ไม่ได้เล่นสล็อตxo กับเรานั้น คุณก็มาเป็นสมาชิกหรูๆแบบ y2k กับพวกเรา slot auto ได้เช่นเดียวกันนะครับ

เอาล่ะครับ เพื่อไม่ให้เป็นการเสียเวลาครับผม วันนี้ผมจะขอมาชี้แจงและก็บรรยายถึงเหตุผลที่ว่า เพราะเหตุใดจะต้องเล่นสล็อตที่ slotxo auto กันครับผม เรามีดีอะไร? ดียิ่งกว่าเว็บอื่นรึเปล่า? แล้วจะโอเคจริงๆใช่ไหม? วันนี้ผมจะให้คำตอบกับคุณเอง ถ้าเกิดพร้อมแล้ว ก็ไปอ่านกันได้เลยครับผม เลทโก!

1. เกมสล็อตออโต้มากมายค่าย

เกมสล็อตออโต้นั้นมีมากมายเยอะแยะหลากหลายค่ายเลยขอรับ ซึ่งผมก็รู้ดีว่า แต่ละคนนั้นก็มีค่ายเกมในดวงใจนาๆประการ บางบุคคลก็เป็นแฟนของค่ายเกมนี้ บางคนก็ชอบเกมค่ายนั้น เรียกว่า หลากหลายความชื่นชอบในแต่ละเกมเลยนะครับ ซึ่งทาง สล็อตxo ก็ทราบเหตุผลข้อนี้ดีขอรับ ทางพวกเราจึงไม่ได้มีแต่ว่าเกมจากค่าย xoslot แค่นั้น ก็ยังคงมีเกมดังเกมฮิตจากทุกๆค่ายมาด้วย ไม่ว่าจะเป็น PG Slot, Pragmatic Play, Jili, สล็อตออโต้ Ask Me Bet หรือ Amb Slot เป็นต้น เพื่อให้ตอบโจทย์กับลูกค้า

มากที่สุดนั่นเองครับ

การที่เว็บ slot auto มีเกมจากมากมายค่าย มันก็ทำให้ทุกคนไม่ต้องไปนั่งแปลงเว็บไซต์เวลาจะแปลงค่ายเกมเล่น ทำให้ท่านสามารถเล่นเกมค่ายไหนก็ได้ ชอบเกมไหนก็เล่นเกมนั้น ซึ่งมันง่ายและสะดวกกับลูกค้าทุกคนมากมายๆขอรับ ด้วยเหตุผลดังกล่าวแล้ว นี่ก็เลยยอดเยี่ยมในคุณลักษณะเด่นของ slotxo auto ของพวกเราที่อยากจะให้ท่านได้ลองสัมผัสประสบการณ์การเล่นสล็อตออนไลน์ที่ดีแล้วก็เอนจอยที่สุดนั่นเองขอรับ

2. โปรโมชั่นดี กิจกรรมเด่น เล่นยังไงก็มั่งมี

ในบทความก่อนๆผมได้พูดถึงโปรโมชั่นและก็กิจกรรมของ slotxo auto ไปหมดแล้ว ซึ่งผมบอกเลยจ้าครับผมว่า

เว็บไซต์สล็อตออโต้ต่างๆจะอยู่ได้ไหมได้นั้น มันก็ขึ้นกับความชอบใจของลูกค้าที่มีต่อโปรโมชั่นรวมทั้งกิจกรรมของเว็บไซต์นี่แหละ ซึ่งทาง slotxoauto.com ก็มองเห็นถึงจุดนี้แบบเดียวกันครับ เราก็เลยจัดโปรโมชั่นรวมทั้งกิจกรรมแบบจัดหนักจัดเต็มกันไปเลยนะครับ ไม่ว่าจะเป็น โปรโมชั่นสมาชิกใหม่ รับโบนัส 50% โปรโมชั่นทุกยอดฝาก รับโบนัส 10% หรือจะเป็นโปรโมชั่น Cash Back 2% ที่มารับยอดเสียของตนได้ไม่อั้น เรียกว่าตอบปัญหาทุกความอยากเลยครับผม

ในส่วนของกิจกรรมก็มิได้น้อยหน้าเลยนะครับ อีกทั้งกิจกรรมชวนเพื่อนซี้สมัคร รับ 2 กระเด้ง ที่จะทำให้ท่านได้รับอีกทั้งเครดิตฟรี 100 บาท และก็ยอดเสียจากเพื่อนพ้อง 5% กิจกรรมปฏิทินเช็คชื่อรับโชค ที่จะทำให้ท่านได้รับเครดิตฟรีๆไปเลยหากทำได้ หรือจะเป็นกิจกรรม Login ที่จะแจกเพชรให้คุณเอาไปหมุนวงล้อลุ้นรับเครดิตฟรีกันได้วันแล้ววันเล่า ซึ่งผมบอกเลยว่า เครดิตฟรีที่เรามอบให้ มีตั้งแต่ว่าหลักสิบบาทไปจนถึงหลักพันเลยครับผม ไม่แน่ครับว่า เครดิตฟรีหลักพันบางทีอาจจะเป็นของคุณก็ได้

3. แอดไม่นคุยง่าย ตอบได้ทุกปริศนา

ผู้ใดกันแน่ที่เคยพบแอดมินดุๆหรือพูดจาห่วยแตกๆใส่ล่ะก็ มาเล่นที่ สล็อตออโต้ คุณจะเสมือนพบโลกใบใหม่เลยครับผม เพราะ ทาง xoslot ของพวกเรานั้นให้ความเอาใจใส่กับการบริการมากๆเราไม่ต้องการให้คุณพบกับแอดไม่นที่พูดจาแย่ๆตอบช้า ตอบปัญหาไม่ได้ หรือแก้ไขปัญหาให้ไม่ได้แน่นอนขอรับ ทางเราต้องการให้ทุกคนที่มาเล่นสล็อตออโต้กับเรานั้นได้รับการบริการ

ที่ดีเยี่ยมที่สุด เพื่อคุณสามารถเล่นสล็อตออโต้บนเว็บไซต์ของเราได้อย่างสบายใจ ถ้าเกิดปัญหาอะไรก็ตามแต่ว่า แอดไม่นของเราพร้อมดูแลรวมทั้งขจัดปัญหาให้คุณตลอด 24 ชั่วโมง อุ่นใจได้ทุกเวลา ไม่ว่าจะฝากถอนมิได้ เกมค้าง หรืออะไรก็ตามแม้กระนั้น ให้เราช่วยดูแลครับผม

เป็นไงบ้างครับผมกับ เหตุผลที่ว่าทำไมจำเป็นต้องเล่นสล็อตที่ slotxo ผมบอกเลยว่านี่เป็นเพียงแต่ข้อดีรวมทั้ง

คุณลักษณะเด่นน้อยแค่นั้นที่ผมต้องการจะนำเสนอทุกคน ทั้งลูกค้าเก่าที่กำลังลังเลว่าจะแปลงเว็บ หรือลูกค้าใหม่ก่อนหน้านี้เจอเรา ผมก็ขอฝาก slotxoauto.com ไว้ด้วยนะครับ สำหรับวันนี้ ผมจำต้องขอตัวลาไปก่อน แล้วเจอกันใหม่ในบทความหน้า สวัสดีครับ

slotxo ฟรีเครดิต slotxo auto Slotxoauto.com 16 ม.ค. 2023 Mose คาสิโนออนไลน์ สล็อตออโต้เว็บไหนดี Top 10

ขอขอบคุณมากreference สล็อตออโต้

สล็อตคาสิโน https://m.hengjing168.win 27 MAR 2566 สล็อตคาสิโน โปรสล็อตแจกโบนัสทุกวัน ค่ายใหญ่หารายได้เสริม สล็อต ในเว็บเดียว Top 54 by Arlie

3 กรรมวิธีเลือกเกมสล็อตออนไลน์

สวัสดีขอรับชาว m.hengjing168.win 168สล็อต ทุกท่าน มาอยู่กับผมอีกแล้วครับผม! ในบทความก่อนๆผมได้เขียนถึงเทคนิคหรือเคล็บลับการเล่นสล็อตออนไลน์กันไปบ้างแล้ว ซึ่งก็มีคนจำนวนไม่น้อยข้างหลังไมค์มาถามผมว่า แล้วถ้าเกิดจำเป็นต้องเลือกเกมสล็อตออนไลน์ด้วยตัวเอง ต้องเลือกแบบไหนล่ะ จึงควรมองอะไรบ้าง หลายๆรีวิวพูดว่าให้เลือกเกมนี้ เกมนั้น ซึ่งหลายท่านที่เป็นมือใหม่เพียงพอไปเล่นตามแล้วก็เสียบ้าง ไม่ได้บ้าง เล่นมิได้แบบรีวิวบ้าง ก็พลอยหดหู่กันไป ผมรู้กันดีเลยนะครับ

มันก็เลยเป็นต้นเหตุของบทความในวันนี้ขอรับกับ 3 กรรมวิธีเลือกเกมสล็อตออนไลน์ ซึ่งผมจำต้องบอกก่อนเลยจ๊ะขอรับว่า การเลือกเล่นเกมสสล็อต168เกมใดก็ตาม ไม่ได้การันตีว่าคุณจำเป็นที่จะต้องเล่นได้หรือเปล่าเสียเลยนะนะครับ สำหรับผม ผมจะบอกทุกคนเสมอว่า การเล่น168สล็อตที่ดีคือ พวกเราเล่นแล้วมีความสุข เล่นแล้วมีกำไร แล้วก็เล่นแล้วไม่ตกระกำลำบากคนใด ซึ่งถ้าเกิดคุณเล่นเสีย

มันก็เลยเป็นต้นเหตุของบทความในวันนี้ขอรับกับ 3 กรรมวิธีเลือกเกมสล็อตออนไลน์ ซึ่งผมจำต้องบอกก่อนเลยจ๊ะขอรับว่า การเลือกเล่นเกมสสล็อต168เกมใดก็ตาม ไม่ได้การันตีว่าคุณจำเป็นที่จะต้องเล่นได้หรือเปล่าเสียเลยนะนะครับ สำหรับผม ผมจะบอกทุกคนเสมอว่า การเล่น168สล็อตที่ดีคือ พวกเราเล่นแล้วมีความสุข เล่นแล้วมีกำไร แล้วก็เล่นแล้วไม่ตกระกำลำบากคนใด ซึ่งถ้าเกิดคุณเล่นเสีย

อย่างต่ำคุณก็จำเป็นต้องเล่นอย่างมีความสุขและไม่ตกระกำลำบากผู้ใดกันแน่ จริงไหมล่ะครับผม เพราะฉะนั้น ต้นเหตุที่จะทำให้ท่านเล่นแล้วเป็นสุข คุณก็ต้องเลือกเกมที่คุณจะเล่นแล้วสุขสบายจริงไหมล่ะครับ ซึ่งผมจะมาชี้แนะคุณในเรื่องนี้เองนะครับ

เอาละครับผม เพื่อไม่ให้เป็นการเสียเวลาครับผม สักครู่เรามาดูไปพร้อมเพียงกันเลยครับผมว่า 3 หนทางในวันนี้ที่ผมจะมานำเสนอ 168สล็อต กระบวนการเลือกเกมสล็อตออนไลน์จะมีอะไรบ้าง มันจะเล่นแล้วแฮปปี้จริงๆไหม พวกเรามาดูกันขอรับ ถ้าหากคุณพร้อมและก็มาดูไปพร้อมเพียงกันเลยขอรับ เลทโก!

1. เลือกเกมสล็อตออนไลน์แบบไม่มีไลน์เดิมพัน สล็อตออนไลน์

1. เลือกเกมสล็อตออนไลน์แบบไม่มีไลน์เดิมพัน สล็อตออนไลน์

บางทีก็อาจจะเป็นเกม168สล็อตที่แปลกใหม่เอาซะหน่อยครับผม เพราะธรรมดาแล้ว เกมสล็อต168นั้นจะมีการบอกไลน์เดิมพันที่ชนะแบบเด่นชัดเลยครับ ยิ่งเกมสล็อต168เกมไหนมีรีลแล้วก็แถวเยอะแยะ เกม168สล็อตเกมนั้นก็จะยิ่งมีไลน์เดิมพันที่ชนะมากมายตามไปด้วย ซึ่งนี่ถือเป็นเกมสล็อตออนไลน์แบบทั่วไปเลยครับ แต่สำหรับเกมสล็อตออนไลน์แบบไม่มีไลน์พนันนั้นจะต่างกันออกไป เพราะวิธีชนะเกมสล็อตออนไลน์จำพวกนี้จะใช้แนวทางนับจำนวนสัญลักษณ์ทั้งผองที่อยู่บนเพลานะครับ ดังเช่นว่า เครื่องหมายนี้ปรากฏ 10 อันขึ้นไปก็จะได้รางวัล ซึ่งมันจะนับรวมสัญลักษณ์แต่ละเครื่องหมายทั้งหมดทั้งปวงเลยครับ นั่นถือได้ว่า คุณอาจจะชนะรางวัลมากกว่า 1 รางวัลด้วยซ้ำ มันก็จะยิ่งเพิ่มโอกาสให้ท่านได้กำไรจากเกมสล็อต168จำพวกนี้ไปได้เลยนั่นเองขอรับ ซึ่งเกมที่ผมอยากจะเสนอแนะก็จะมีเกม168สล็อตที่ชื่อว่า Candy Bonanza หรือ Candy Birst ที่บอกเลยว่า สล็อตออนไลน์ สนุกสนานมาก จ่ายรางวัลหนักมากมาย รวมทั้งที่สำคัญ เป็นเกมสล็อตออนไลน์รูปแบบใหม่ที่คุณคงจะเล่นได้ไม่มีเบื่อแน่นอนครับ

2. เลือกเกมสล็อตออนไลน์จากอัตราการจ่ายเงินรางวัล สล็อต

ไม่ว่าจะเป็นเกมสล็อตออนไลน์แบบที่มีไลน์พนันหรือเปล่ามีพนัน ในแต่ละเกมสล็อต168นั้นก็จะมีบอกอัตราการจ่ายเงินรางวัลเสมอนะครับ ก่อนที่คุณจะเข้าเล่นเกม168สล็อตทุกหน ขอให้คุณได้ดูก่อนเป็นอันดับแรกเลยนะครับว่า เกมสล็อต168ที่คุณกำลังจะเล่นนั้น มีอัตราการจ่ายเงินรางวัลสมควรรึเปล่า ไลน์พนันที่ชนะน้อยอย่างนี้ อัตราการชำระเงินรางวัลน้อยอีก ก็ไม่สมควรเล่นแล้วครับ เนื่องจากว่าโอกาสชนะก็ยาก แถมชนะมาก็ไม่ใช่ว่าจะคุ้ม ซึ่งตรงจุดนี้ล่ะขอรับที่ผมต้องการจะให้ทุกคนทดลองเลือกรวมทั้งดูเกมสล็อตออนไลน์ที่จะเล่นไปนานๆ

ยิ่งไปกว่านี้ คุณยังสามารถประเมินความเสี่ยงของแต่ละเกมสล็อต168 จากอัตราการชำระเงินรางวัลได้ด้วย ให้คุณพึงจะรำลึกไว้เสมอเลยคะครับว่า เกมที่มีอัตราการจ่ายเงินรางวัลสูง จะมีเปอร์เซ็นต์สำหรับการชนะแจ็คพอตต่ำ ส่วนเกมที่มีอัตราการจ่ายเงินรางวัลต่ำ จะมีเปอร์เซ็นต์สำหรับในการชนะแจ็คพอตสูง มันก็จะสลับกันไปนะครับ ซึ่งถามว่า เกม168สล็อตที่อยู่กลางมีไหม

ก็มีครับผม ซึ่งในส่วนนี้คุณสามารถเลือกได้ตามทักษะและความชอบใจของคุณเองเลยครับผมว่า พร้อมจะรับความเสี่ยงได้

มากน้อยแค่ไหน

3. เลือกเกมสล็อตออนไลน์ที่ถูกใจแค่นั้น ทางเข้าสล็อต168

หากจะเล่นสล็อต1618ให้มีความสุข คุณก็จำเป็นต้องเลือกเกมที่คุณชอบเท่านั้นแหละขอรับ เกม168สล็อตไม่ว่าจะมีไลน์เดิมพันไหมมีไลน์พนัน ก็ขอให้เป็นเกมสล็อตออนไลน์ที่คุณได้เล่นแล้วถูกใจสูงที่สุดก็พอเพียงครับ ภายหลังจากคุณประเมินทุกๆอย่างแล้วไม่ได้ถูกใจเกมนั้นๆขนาดนั้น เล่นแล้วรู้สึกไม่คลิกไหมประทับใจ ก็ไม่ต้องเล่นดียิ่งกว่าครับ ผมต้องการให้ทุกคนได้เล่นเกมสล็อตออนไลน์ที่คุณเล่นแล้วจะเอนหน้าจอยมากกว่า เนื่องจากอย่างน้อยที่สุด ถ้าหากคุณเล่นเสีย คุณก็ยังสนุกที่ได้เล่นกับมันนั่นเองนะครับ มันก็ดังเวลาเราเล่นเกมนั่นแหละขอรับ เล่นแพ้บ้าง ชนะบ้าง แต่พวกเราก็บันเทิงใจที่ได้เล่น เพราะเหตุว่านี่คือเกมที่เราชอบถูกไหมล่ะครับ โดยเหตุนี้ ก็อยากที่จะให้เลือกเกมที่ตัวเองถูกใจนั่นแหละครับ ใครกันแน่จะว่ายังยังไงก็ตาม พวกเราสนุกก็พอแล้วขอรับ

เป็นไงบ้างครับผมกับ 3 วิถีทางในการเลือกเกมสล็อตออนไลน์ ผมบอกเลยว่า คุณจะเป็นสุขและก็เอนหน้าจอยกับการเล่นสล็อต168เพิ่มขึ้นเรื่อยๆเลยล่ะนะครับ ซึ่งเรา สล็อตคาสิโน ก็ยังมีเกม168สล็อตให้คุณเลือกอีกเยอะแยะล้นหลาม เกมสล็อตแบบมีไลน์เดิมพันไหมมีไลน์เดิมพันก็พร้อม ใครถูกใจแบบไหนก็จัดได้เลยครับผม ยิ่งช่วงนี้มีโปรโมชั่นสมาชิกใหม่และโปรโมชั่นทุกยอดฝากด้วยล่ะก็ ห้ามพลาดเลยจ้ะครับผม สำหรับวันนี้ ผมจำเป็นต้องขอตัวลาไปก่อน แล้วเจอกันใหม่ในบทความหน้าครับผม สวัสดีครับ

เกม168 168สล็อต M.hengjing168.win 3 มีนา 2566 Arlie แจ็คพอตแตกเยอะ สล็อต168game 168 Top 33

ทางเข้าสล็อต168 ขอขอบพระคุณwebsite ทางเข้าสล็อต168

https://bit.ly/hengjing168-win

https://rebrand.ly/hengjing168-win

สล็อตเว็บตรงเว็บไหนดี เว็บสล็อต https://Punpro777.com 21 ส.ค. 2565 สล็อต เว็บตรงไม่ผ่านเอเย่นต์ไม่มีขั้นต่ำ เพราะคนนิยมเล่นสล็อตเว็บตรง777 สล็อตออนไลน์ เครดิตฟรี

แจกเครดิตฟรี ปั่นโปร โบนัสแตกง่ายดาย ทุนต่ำ มั่งคั่งไม่ยากกับ Punpro777

แจกเครดิตฟรี ปั่นโปร โบนัสแตกง่ายดาย ทุนต่ำ มั่งคั่งไม่ยากกับ Punpro777

นักพนันท่านไหน ที่กำลังตามหาเกม สล็อต โบนัสแตกง่าย เราขอเสนอแนะให้แก่คุณเข้ามาใช้บริการ ผู้ให้บริการเกมเป็นที่นิยมจากค่ายชั้นสูงสุด ซึ่งหมายถึงเกม สล็อตเว็บไซต์ตรง แตกง่าย pg ทุนต่ำก็สามารถเข้าเล่นได้ แถมยังอาจจะทำเงินก้อนโตได้แบบสบายๆอีกด้วย เพราะเหตุว่าเกมสล็อตทุกเกม มีแจ็คพอตที่ออกหลายหน แล้วก็เพราะว่าว่าเป็นเกม สล็อตแตกง่ายเว็บตรง ก็เลยทำให้เกมสล็อตของทางพวกเรานั้น กำลังเป็นที่ชื่นชอบเป็นอย่างยิ่งในตอนนี้ ซึ่งเราแน่ใจว่าถ้าหากนักการพนันท่านไหนที่รู้สึกชื่นชอบ เล่นเกมสล็อตอยู่เป็นประจำ ต้องพอใจเป็นอย่างแน่นอน ถ้าเกิดได้เข้าเล่นเกมกับ punpro777.com

นักพนันท่านไหน ที่กำลังตามหาเกม สล็อต โบนัสแตกง่าย เราขอเสนอแนะให้แก่คุณเข้ามาใช้บริการ ผู้ให้บริการเกมเป็นที่นิยมจากค่ายชั้นสูงสุด ซึ่งหมายถึงเกม สล็อตเว็บไซต์ตรง แตกง่าย pg ทุนต่ำก็สามารถเข้าเล่นได้ แถมยังอาจจะทำเงินก้อนโตได้แบบสบายๆอีกด้วย เพราะเหตุว่าเกมสล็อตทุกเกม มีแจ็คพอตที่ออกหลายหน แล้วก็เพราะว่าว่าเป็นเกม สล็อตแตกง่ายเว็บตรง ก็เลยทำให้เกมสล็อตของทางพวกเรานั้น กำลังเป็นที่ชื่นชอบเป็นอย่างยิ่งในตอนนี้ ซึ่งเราแน่ใจว่าถ้าหากนักการพนันท่านไหนที่รู้สึกชื่นชอบ เล่นเกมสล็อตอยู่เป็นประจำ ต้องพอใจเป็นอย่างแน่นอน ถ้าเกิดได้เข้าเล่นเกมกับ punpro777.com

โบนัสแตกง่ายมาก ที่ได้รับความนิยม ช่วยคุณได้จริง

โบนัสแตกง่ายมาก ที่ได้รับความนิยม ช่วยคุณได้จริง

punpro โบนัสแตกง่าย เกมพนันยอดนิยม มาแรงแซงทุกเกม มีผู้เข้าเล่นอย่างสม่ำเสมอ แถมยังได้ขึ้นชื่อว่าเป็นเกม สล็อต punproแตกง่าย แจกจริง ทั้งมวลนี้ ล้วนแล้วแต่เป็นคำรับรอง จากนักพนันเข้าใช้งานจริง ยืน 1 ในหัวข้อการแจกรางวัล ที่แจกหนักจัดใหญ่ทุกยอด ทั้งยังเปิดให้ทุกคนเข้าพนันได้แบบไม่มีอย่างต่ำ บันเทิงใจมัน ปั่นแจ็คพอตออกมาก รับผลกำไรย้ำๆไปกับ สล็อต โบนัสแตกง่าย แถมถ้าหากได้เข้ามาลงพนันกับทางเว็บของพวกเรา ไม่ต้องกลัวว่ายูสของท่านจะโดนล็อค ด้วยเหตุว่าทางพวกเราเป็นเว็บ สล็อตเว็บตรงแตกง่ายไม่ล็อคยูส เล่นง่าย ทำเงินได้ไวเกินคนไหนกันแน่ อีกหนึ่งเกมออนไลน์ ที่น่าสนใจสูงที่สุดตอนนั้น

ในเวลานี้มีเว็บเกมสล็อตเปิดให้เข้าใช้บริการมากมาย แม้ว่ายังมีนักพนันงงกันจำนวนหลายชิ้นว่า เว็บสล็อตแตกง่ายที่สุด จะหาเล่นถึงที่กะไว้ไหน เราขอบอกเลยว่าท่านจำเป็นจะต้องเข้ามาเล่น เว็บไซต์ให้บริการเกมสล็อตแตกหลายทีกว่าเดิม มีตัวเกมที่น่าเล่นแปลกใหม่กว่าคนไหน แถมยังได้มีการอัพเดทระบบเกมใหม่ การันตีว่าถ้าได้เข้าเล่น สล็อตแตกบ่อยครั้ง มากยิ่งกว่าใครๆหรือท่านไหนที่อยากได้เข้าเล่นเกมสล็อต พร้อมกับทำรายได้ก้อนโต ยิ่งควรต้องเข้ามาเล่นที่ตรงนี้ ยืนยันว่าได้ผลลัพธ์ที่ดีแน่ๆหมุนมัน ปั่นสนุกไปกับ สล็อต โบนัสแตกง่าย การันตีว่าดีเยี่ยมที่สุด พนันง่าย แจ็คพอตมาก พร้อมลุ้นรับสินทรัพย์เงินโตได้ทุกวัน

ไม่ต้องลงทุนมากมาย แม้กระนั้นช่วยคุณได้ดี

เกมสล็อตออนไลน์ ที่ไม่มีความจำเป็นต้องลงทุนจำนวนมาก ก็สามารถได้กำไรได้แบบง่ายๆเข้าเล่นได้กับ สล็อต เว็บไซต์ตรงไม่ผ่านเอเย่นต์ไม่มีอย่างต่ำ เล่นครึกครื้น ปลอดภัย วางใจได้ตลอดทั้งการเดิมพัน ที่สำคัญแม้ได้เงินจากการที่โบนัสแจ็คพอตแตกเท่าไร ก็สามารถถอนได้เลย ไม่จำกัด เปิดให้บริการเกม สล็อตแตกหนัก แล้วในช่วงเวลานี้ สามารถร่วมเล่น พร้อมด้วยทำเงินก้อนโตได้เลย มั่นใจว่านักการพนันทุกคน ต้องติดอกติดใจตั้งแต่แรกที่ได้เข้าเล่น ดีไม่ดีบางครั้งก็อาจจะสามารถสร้างเงินมากมายก่ายกอง กลับไปได้ไม่ยาก จากการเล่น สล็อต โบนัสแตกง่าย เกมดีมีคุณภาพ ค้ำประกันทุกความเพลิดเพลินเกินผู้ใดกันแน่ เล่นเข้าใจง่ายแถมยังมีอัตราจ่ายสูงสุด

เกมที่ได้รับความนิยมจากค่ายชั้นสูงสุด ที่มาแรงที่สุด 2022 แจ็คพอตแตกหลายครั้ง มีทุนในการลงพนันต่ำ ก็สามารถทำเงินได้แบบสบายๆแถมยังมีระบบระเบียบเกมใหม่ที่น่าเล่น รวมทั้งแตกหลายครั้งกว่าเดิม ที่สำคัญยังเป็นเกมที่ยิงมาจาก เว็บไซต์ตรงไม่ผ่านเอเย่นต์ เข้าเล่นได้แบบไม่มีอันตราย หายห่วง สามารถลงทุนได้แบบไม่มีอย่างต่ำ มีโบนัสแจ็คพอตในเกมที่แจกจริงแจกหนัก เล่นได้เท่าไร ถอนได้เท่านั้น ไม่กำจัด คนไหนกันที่อยากได้เข้ามาเล่นเกม สล็อต โบนัสแตกง่าย สามารถเข้ามาเล่นได้เลย พร้อมให้บริการโดย เว็บไซต์สล็อตแตกง่าย ชั้น 1

เว็บไซต์แห่งนี้แหละของจริง ช่วยได้เยอะแยะเลย

เปิดให้บริการ เว็บสล็อต สำหรับผู้ที่ทุนน้อย ที่ปรารถนาเล่นเกมสล็อต แม้ว่าไม่รู้เรื่องจะเล่นกับเว็บไซต์ไหนดี เว็บไซต์ สล็อตแตกง่าย ทุนน้อย ตอนนี้ เป็นแนวทางที่น่าสนใจอย่างยิ่งจริงๆด้วยเหตุว่าเป็นเว็บที่เปิดใหม่ ที่ดีไม่แพ้เว็บไซต์สล็อตรุ่นพี่อย่างแน่แท้ แถม สล็อตทุนน้อย แตกหนัก ยังมีการแจกโบนัสแบบจำนวนมากผู้ใดกันแน่ที่มีทุนน้อยก็ได้โอกาสพนันได้ในทันทีทันใด จัดเตรียมรับรางวัลชุดใหญ่จาก สล็อตแตกง่าย ทุนน้อย เดี๋ยวนี้

ยังมีจุดเด่นต่างๆที่ผูกหัวใจผู้เล่น ไม่ว่าใครจะเล่นกับเว็บไซต์เรา ก็ต่างพี่จะพอใจกลับมาเล่นซ้ำ ถ้าเกิดคนไหนกันยังไม่ได้เป็นพวกกับ เว็บสล็อตแตกง่าย แจกจริง ก็สามารถสมัครได้ตามขั้นตอนที่พวกเราแนะนำเลย พร้อมรับเครดิตฟรีในทันที ไม่ต้องทำยอดเทิร์น สามารถถอนได้จริง สล็อตแตกง่าย ทุนน้อย ปัจจุบันนี้ เปิดกว้างให้ทุกคนสามารถทำเงินรายได้เสริมก็ได้จริงๆโดยที่ไม่มีหลอกลวง ไม่มีกั๊ก ไม่มีคดโกง

หากว่าคนใดปรารถนาเล่น สล็อตแตกง่าย ทุนน้อย เดี๋ยวนี้ แต่ว่าไม่มีบัญชีธนาคาร จะไม่ใช่ปัญหากับท่านอีกต่อไป ด้วยเหตุว่า สล็อตแตกง่าย ทุนน้อยวอเลท ได้เปิดระบบใหม่ก็เป็นฝาก-ถอน ผ่านวอเลท นั่นเอง ขอบอกเลยว่าสบายต่อทุกคน เหมาะสมกับเด็กๆที่อยากลงเล่นกับ สล็อตแตกง่าย ทุนน้อย ปัจจุบันนี้ แม้กระนั้นยังไม่มีบัญชีธนาคาร หรือยังอายุไม่ถึงที่จะสามารถเปิดธนาคารเองได้ ก็ใช้วอเวทในการฝากเบิกเงินกับเว็บ

เว็บสล็อต แตกง่าย ได้เลย และยังมีอย่างต่ำสำหรับในการลงพนันเพียง 1 บาท เท่านั้นเอง ไม่ต้องทำยอดก็สามารถถอนได้ทันทีทันใด หากว่าคนไหนกันแน่เข้ามาเล่นกับเว็บ สล็อตทุนน้อย แตกง่าย ก็เตรียมตัวเตรียมใจที่จะเป็นคนมั่งคั่งได้เลย เนื่องจากว่า สล็อตแตกง่าย ทุนน้อย ตอนนี้ มีการแข่งขันน้อย เป็นเว็บที่เปิดใหม่คู่ต่อสู้ก็น้อย ก็เลยทำให้รางวัลได้ช่องเป็นของท่านสูงมากมายๆ

ปันโปร https://PunPro777.com 2 กันยายน 2022 เว็บตรงไม่ผ่านเอเย่นต์ 2022 ดูยังไง สมัครเครดิตฟรี punpro777 websiteตรงนี้ได้เลย

ขอขอบคุณมากweb แจกเครดิตฟรี

918vip.co สล็อต918kiss 3 Dec 65 เว็บแตกง่าย 918kiss android ดาวน์โหลด918kissเว็บเปิดใหม่ สมัคร918kiss ทดลองเล่น Top 40 by Dotty

ดาวน์โหลด918kiss ทางเข้า 918kiss 918vip.co 24 December 65 Dotty คาสิโนออนไลน์ สมัคร918kissที่ฮิตที่สุด Top 95

ดาวน์โหลด918kiss ทางเข้า 918kiss 918vip.co 24 December 65 Dotty คาสิโนออนไลน์ สมัคร918kissที่ฮิตที่สุด Top 95

สมาชิกใหม่รับ 50% จาก 918VIP

สมาชิกใหม่รับ 50% จาก 918VIP

สวัสดีครับผมชาว โหลด918kissล่าสุด ทุกท่าน ในตอนอาทิตย์ที่แล้ว ทางพวกเราได้มองเห็นปัญหาการแบน URL ของผู้ให้บริการอินเตอร์เน็ตหลายๆค่าย ไม่ว่าจะเป็นทรู ดีแทค หรือเอไอเอส เรียกว่าแบนกันซ้ำๆ ทางเข้า 918Kiss ของทางพวกเราก็หวั่นๆเช่นเดียวกัน ฉะนั้น เพื่อให้ทุกคนยังสามารถเล่น 918kiss ได้อย่างสบายใจ ทางผมจะทิ้งลิงก์ ดาวน์โหลด918kiss ไว้ให้นะครับ เผื่อในอนาคตโดนแบน URL ทุกท่านก็จะสามารถเข้าได้ตามเดิมนั่นเองนะครับ ขอโทษในความขัดข้องด้วยครับ

สวัสดีครับผมชาว โหลด918kissล่าสุด ทุกท่าน ในตอนอาทิตย์ที่แล้ว ทางพวกเราได้มองเห็นปัญหาการแบน URL ของผู้ให้บริการอินเตอร์เน็ตหลายๆค่าย ไม่ว่าจะเป็นทรู ดีแทค หรือเอไอเอส เรียกว่าแบนกันซ้ำๆ ทางเข้า 918Kiss ของทางพวกเราก็หวั่นๆเช่นเดียวกัน ฉะนั้น เพื่อให้ทุกคนยังสามารถเล่น 918kiss ได้อย่างสบายใจ ทางผมจะทิ้งลิงก์ ดาวน์โหลด918kiss ไว้ให้นะครับ เผื่อในอนาคตโดนแบน URL ทุกท่านก็จะสามารถเข้าได้ตามเดิมนั่นเองนะครับ ขอโทษในความขัดข้องด้วยครับ

สำหรับบทความในวันนี้ ผมจะมาเจาะลึกโปรโมชั่นดีๆจาก 918VIP กันขอรับ โปรโมชั่นเยอะมากล้นหลามพื้นที่พวกเรา

จัดไว้ให้ทุกคน มันมีจุดเด่นที่ไหน คุ้มไหม แล้วหากผมในฐานะลูกค้า ผมจะรับหรือเปล่ารับ วันนี้มาดูกันเลยครับผม รวมทั้งโปรโมชั่นแรกที่ผมเลือกในวันนี้ก็คือ สมาชิกใหม่รับ 50% ขอรับ ถ้าเกิดพร้อมรวมทั้งเลทโก!

1. โปรโมชั่น สมาชิกใหม่รับ 50%

สำหรับโปรโมชั่น สมาชิกใหม่รับ 50% เป็นโปรโมชั่นที่ดิน 918VIP วางแบบมาสำหรับสมาชิกใหม่โดยเฉพาะขอรับ โดยสมาชิกใหม่ เมื่อฝากอย่างน้อย 100 บาทขึ้นไป สามารถกดรับโปรโมชั่นนี้ได้ ท่านจะได้รับเครดิตเพิ่มเติมอีก 50% สูงสุด 500 บาท เรียกว่า ถ้าหากฝาก 1,000 บาท ก็รับไปเลย 1,500 บาทขอรับ แจกเยอะมาก! แม้กระนั้นโปรโมชั่นนี้มีเงื่อนไขว่า ท่านต้องทำยอด ดาวน์โหลด918kiss 3 เท่า ถึงจะถอดได้นะครับ เท่ากับว่า ถ้าท่านฝาก 1,000 บาทแล้วรับโบนัสด้วย เป็น 1,500 บาท ก็จึงควรทำยอดให้ได้ 4,500 บาท ถึงจะถอนได้นั่นเองขอรับ เรียกว่าคุ้มมากๆและก็โปรโมชั่นนี้สามารถเล่นได้เฉพาะสล็อต สมัคร918kiss แล้วก็ยิงปลาเท่านั้นนะครับ

2. ให้แต้มกันหน่อย

สำหรับคะแนนความคุ้มราคาของโปรโมชั่นนี้ ผมให้ 10/10 เลยนะครับ เนื่องจากโปรโมชั่นนี้ยอมรับได้เฉพาะสมาชิกใหม่เพียงแค่นั้น และยอมรับได้เพียงแค่ครั้งเดียวด้วย การแจกเครดิตฟรีๆให้ถึง 50% มันเป็นอะไรที่เวอร์มากๆโดยเหตุนี้แล้ว ถ้าหากทาง 918VIP แจกให้แล้ว

ก็รับไว้เถิดครับ คุ้มแน่ๆนะครับ

3. โปรโมชั่นดี พี่จะรับป้ะ?

แน่นอนว่า ผมรับแน่ๆนะครับ ฮ่า… 918kiss เข้าสู่ระบบ อย่างที่ผมบอกไปช่วงต้น โปรโมชั่น สมัคร918kiss นี้แจกเฉพาะสมาชิกใหม่ และแจกเพียงแค่ทีแรกครั้งเดียวเพียงแค่นั้น ดังนั้นไร้เหตุผลอะไรเลยครับผมที่ผมจะไม่รับ ผมไม่จำเป็นที่ต้องฝากถึง 1,000 บาทเพื่อรับโบนัสสูงสุดก็ได้

เนื่องจากเพียงแค่ฝากขั้นต่ำ 100 บาทขึ้นไป ผมก็ได้เครดิตฟรี 50% อยู่ดีนั่นเองครับ

แล้วก็ผมขอรับรองคำตอบสุดท้ายว่า รับขอรับ!

เป็นยังไงบ้างขอรับกับ สมาชิกใหม่รับ 50% จาก 918VIP ถ้าเป็นคุณจะรับไหมล่ะครับ? ฮ่า… สำหรับท่านไหน

ที่ยังมิได้เป็นพวกกับ ดาวน์โหลด918kiss ก็สามารถลงทะเบียนสมัครสมาชิกแล้วมารับโปรโมชั่นนี้ได้เลยจ๊ะขอรับ โปรโมชั่นดีแน่นอนขอรับ รับได้เลย แล้วก็อย่าลืมเซฟปากทางเข้า ทางเข้า 918kiss จากทางเราไว้ด้วยนะครับ สำหรับวันนี้ ผมก็จะต้องขอตัวลาไปก่อน แล้วเจอกันใหม่ สวัสดีครับ

ขอขอบคุณweb ดาวน์โหลด918kiss

17 พ.ค. 66ดูหนัง 2566 ดูหนังออนไลน์ 4k พากย์ไทยดูหนัง netflix doonungonlineชัดระดับ HD ดูหนังใหม่ หนังดีรางวัลออสก้า Top 58 by Arden Movieskub.com

เว็บไซต์ดูหนังออนไลน์มาใหม่ปัจจุบัน movieskub ดูหนังใหม่

เว็บไซต์ดูหนังออนไลน์มาใหม่ปัจจุบัน movieskub ดูหนังใหม่

ดูหนังผ่านเน็ต 2023 กับเว็บที่เปิดใช้งานใหม่ล่าสุด ซึ่งเว็บไซต์แห่งนี้เป็นเว็บไซต์ที่มีหนังออนไลน์พร้อม หนังใหม่ชนโรงมาให้มองกัน จัดหนักจัดเต็มในเรื่องของเอฟเฟค ไม่ว่าจะเป็นหนังออนไลน์ที่เป็นที่รู้จักในประเทศใด เว็บไซต์ของเราก็ได้นำมาให้คุณได้มองฟรี เราได้ทำสำรวจพร้อมกับอัพเดตหนัง ภาพยนตร์หรือซีรีส์ที่มาใหม่ ที่กำลังเป็นที่นิยม มาบรรจุไว้บนเว็บของพวกเรา อัดแน่นไปด้วยหนังที่มีภาพชัดเจน เมื่อบริการสตรีมมิ่งเปลี่ยนเป็นข้อสำคัญในชีวิตของพวกเรา ผู้คนก็เลยมองหาวิธีรับชมภาพยนตร์ออนไลน์มากขึ้น ไม่ว่าผู้มีความประสงค์รับชมภาพยนตร์ใหม่ หนังไทย ขบขันหรือละคร บางโอกาสการค้นหาเว็บที่ดีที่สุดที่มีตัวเลือกมากไม่น้อยเลยทีเดียวในราคามีเหตุผลอาจเกิดเรื่องยาก เพื่อช่วยให้การค้นหาง่ายมากยิ่งขึ้น เนื้อหานี้จะให้ภาพรวมของเว็บไซต์ที่ดีที่สุดสำหรับเพื่อการดูภาพยนตร์ออนไลน์ ที่มีให้บริการบนเว็บไซต์ของพวกเรา ซึ่งเป็นเว็บไซต์ดูหนังผ่านเน็ตที่กำลังได้รับความนิยมอย่างยิ่งในปีนี้ เนื่องจากมีการคัดสรรและก็เลือกสรรหนังดีหนังดัง มาไว้บนเว็บของพวกเรา อย่างครบวงจรมากที่สุด

ดูหนังผ่านอินเตอร์เน็ตครบถ้วน ในเว็บไซต์เดียว ดูหนัง 2566

ภาพยนตร์ไทย หนังภาพยนตร์ ซีปรี่ย์ ได้รับความนิยมเยอะขึ้นเรื่อยๆในตอนไม่กี่ปีให้หลัง เนื่องจากว่าผู้ชมต่างแดนได้ปรับปรุงความรู้สึกชื่นชมในรูปแบบการผลิตภาพยนตร์ที่เป็นเอกลักษณ์ของประเทศ ถ้าหากคุณปรารถนาดูภาพยนตร์ระดับแนวหน้าจากเมืองไทย movieskub เป็นตัวเลือกที่สุดยอด บริการ ดูหนังผ่านอินเตอร์เน็ตฟรี ผ่านเว็บของเรานั้น มีภาพยนตร์ให้เลือกมากมายก่ายกองทั้งยังเก่ารวมทั้งใหม่ โดยเน้นที่หนังไทยโดยเฉพาะอย่างยิ่ง พวกเรานั้นยังมีภาพยนตร์ต่างถิ่นที่คัดสรรมาอย่างยอดเยี่ยม และภาพยนตร์คลาสสิกที่สร้างโดยผู้กำกับคนประเทศอื่น เว็บแห่งนี้มีไว้เพื่อช่วยทำให้ผู้ชมสามารถค้นพบภาพยนตร์จากทั่วโลก กล่าวได้ว่าพวกเราเป็นเว็บไซต์ดูหนังออนไลน์ ที่มีบริการครบจบในที่เดียว ซึ่งเปิดขึ้นมาให้คนที่ติดอกติดใจดูหนังเป็นชีวิตจิตใจ ได้เลือกใช้บริการ โดยไม่จำเป็นจึงควรทำการล็อกอินเข้าสู่ระบบ ให้ราวกับบริการผ่านแอปพลิเคชันที่มีอยู่ทั่วไปในขณะนี้ เนื่องจากมีแอพพลิเคชั่นมากไม่น้อยเลยทีเดียวที่เปิดให้ใช้งาน แม้กระนั้นบางครั้งอาจจะนำเข้าหนัง ให้ดูช้าอาจจะข้ามปี ทำให้ท่านเสียอรรถรสสำหรับในการรอดูหนังที่คุณชอบใจนั้นไป ซึ่งไม่เหมือนกับเว็บไซต์ของเรา

หนังออนไลน์ดูฟรีไม่ต้องลงทะเบียนเป็นสมาชิก ดูหนัง 2566

เมื่อเอ๋ยถึงการค้นหาภาพยนตร์ที่ยอดเยี่ยมสำหรับระบบออนไลน์เว็บแห่งนี้ เป็นแหล่งเก็บรวบรวม หนังออนไลน์ที่ดีเยี่ยมที่สุด ที่มีการนำเสนอภาพยนตร์และซีรีส์ทางโทรทัศน์ระดับโลกที่คัดสรรมาอย่างน่าประทับใจ โดยเน้นย้ำที่ภาพยนตร์เอเชีย มีซีรีส์ประเทศเกาหลีมาก รวมทั้งภาพยนตร์เกาหลีและก็ต่างประเทศอื่นๆไม่เพียงเท่านั้น ยังมีคำพรรณนาในหลายภาษา ด้วยเหตุผลดังกล่าวผู้ชมต่างถิ่นสามารถเพลินใจกับภาพยนตร์รวมทั้งซีรีส์ต่างๆที่แพลตฟอร์มพรีเซ็นท์ได้อย่างสะดวกสบาย ถือได้ว่าเป็นเว็บ หนังออนไลน์ 2566 ที่จะสร้างรูปแบบการให้บริการ การดูหนังออนไลน์เป็นสิ่งที่ในตอนนี้นั้นกำลังได้รับความนิยมเป็นอย่างมาก รวมทั้งมีผู้ที่ติดอกติดใจเว็บไซต์ดูหนังผ่านเน็ต ซึ่งสามารถดูหนังได้อย่างครบจบในที่เดียวโดยไม่จำเป็นควรต้อง มองหาเว็บอื่น เพราะเว็บไซต์ดูหนังออนไลน์ของเรา มีหนังจากทั่วทิศเอามาใส่ไว้เพื่อผู้ชมได้รับอรรถรสอย่างยอดเยี่ยมที่สุด

หมวดหมู่หนังออนไลน์น่าดึงดูด ดูหนังออนไลน์ 2023

สำหรับเว็บไซต์ดูหนังผ่านเน็ตที่นี้ มีการจัดแยกหมวดหมู่ประเภทการดูหนังออนไลน์ไว้จำนวนมาก เพื่อไม่ยุ่งยากต่อการเลือกเฟ้น การดูหนังออนไลน์ผ่านทางเว็บของพวกเรา นับว่าเป็นสิ่งที่ สามารถทำเป็นง่ายที่สุด รวมทั้งสมควรสำหรับทุกเพศทุกวัย ไม่ว่าใครก็ สามารถเลือก เข้ามาใช้บริการกับเว็บไซต์แห่งนี้ได้ มาดูกันว่าเรามีหนังจำพวกใดให้บริการบ้านดังนี้

• ดูหนังใหม่ หนังใหม่มาแรง หนังชนโรง ทางเว็บของพวกเราได้จัดแยกหมู่ ดูหนังใหม่ ซึ่งหมู่นี้เป็นหมวดหมู่ที่ได้รับความนิยม เพื่อผู้ชม สามารถเลือกดูหนัง ได้ง่ายเพิ่มขึ้นนั่นเอง

• ซีรีย์ดัง ซีรีย์จากทั้งยังในรวมทั้งต่างแดน ทางเว็บของเราก็ได้ใส่ไว้ พร้อมทั้งคำบรรยาย ที่มีหลายประเทศ ช่วยให้ผู้ชม สามารถ ดูหนังได้อย่างเต็มคุณภาพเพิ่มมากขึ้น

• หนังต่างประเทศ ซึ่งหนังต่างประเทศยอดนิยม ทางเว็บไซต์ของพวกเรา ได้เอามาเอาไว้ในหมวดหมู่เดียวกัน เพื่อง่ายต่อการค้นหา

• ภาพยนตร์ตลก แน่นอนว่าหนังหมวดหมู่นี้ ดูหนังออนไลน์ 2023 คนไทยเรานั้นชื่นชอบกันอย่างแน่แท้ จึงเป็นหมวดหมู่ที่ได้รับคำสรรเสริญ และมีผู้คนค้นหามากที่สุด พวกเราจึงได้นำพวกนี้ขึ้นมาเป็นอันดับแรก

นี่เป็นเพียงแค่ส่วนใดส่วนหนึ่ง ที่พวกเราได้ยกตัวอย่างขึ้นมา เพื่อคุณได้เห็นภาพที่กระจ่างแจ้งมากเพิ่มขึ้น ว่าเมื่อเข้ามาใช้บริการกับทางเว็บ จะ สามารถดูหนังออนไลน์ที่เราจัดชนิดและประเภทไว้ให้มีประเภทใดบ้างนั้นเอง

ดูหนังผ่านอินเตอร์เน็ตระบบเสถียร ดูหนัง 2023 รองรับทุกเครื่องมืออิเล็กทรอนิกส์

การดูหนังออนไลน์กับทางเว็บไซต์ของเรา คุณ สามารถใช้ทุกอุปกรณ์อิเล็กทรอนิกส์เพื่อเข้าถึงเว็บนี้ ไม่เพียงแต่การเข้าใช้งานผ่านคอมพิวเตอร์แค่นั้น ถึงแม้ว่าใช้งานผ่านมือถือก็จะ สามารถรับชม หนังที่มีภาพชัดแจ๋ว มีระบบระเบียบที่ช่วยให้คุณดูหนังผ่านเน็ต ได้โดยไม่มีการปิดระบบ ไม่ต้องใช้ตัวเลือกสำรอง ก็ สามารถรับดูหนังออนไลน์ผ่านทางเว็บนี้ ด้วยระบบที่มีคุณภาพ ดังนั้นการเข้ามาใช้บริการกับทางเว็บไซต์ของเรา จึงถือเป็นอีกหนึ่งลู่ทาง ของการดูหนังออนไลน์ที่ดีเยี่ยมที่สุดในขณะนี้

เราเป็นเว็บไซต์ดูหนังผ่านเน็ตสมาชิกใหม่มาแรง ที่เปิดให้บริการคือเพื่อตอบสนองสิ่งที่ต้องการของผู้ชม การดูหนังออนไลน์ผ่านเว็บของพวกเรา จะได้สิ่งที่มากกว่าอรรถรส เพราะคุณจะได้รับความเบิกบานใจที่ดีเยี่ยมที่สุด ที่คุณ สามารถใช้งานได้ฟรีโดยไม่ต้องเสียเงินเสียทองสักบาท ดูหนัง 2023

หนังรักโรแมนติก ดูหนัง 2566 movieskub.com 29 พฤษภา 66 Arden สารคดี ดูหนัง 2566สตรีมหนัง Top 99

หนังรักโรแมนติก ดูหนัง 2566 movieskub.com 29 พฤษภา 66 Arden สารคดี ดูหนัง 2566สตรีมหนัง Top 99

ขอขอบคุณwebsite ดูหนัง 2023

สร้าง qr code รับทำการตลาดออนไลน์สร้างคิวอาร์โค้ดฟรี ไฟล์ PDFแจกโปรแกรม สร้างคิวอาร์โค้ด ลิ้งค์ Qr code Top 75 by Margarette https://qrcode.in.th 23 February 23

ข้อดีของการใช้ QR Code EP.2 Qr code generator

ข้อดีของการใช้ QR Code EP.2 Qr code generator

สวัสดีครับผมทุกคน เป็นไงบ้างขอรับกับ จุดเด่นของการใช้ QR Code EP.1 อย่างที่ผมบอกไปแล้วนะครับว่า

การใช้ QR Code qr code ในตอนนี้นั้นมีจุดเด่นและก็ประโยชน์มากไม่น้อยเลยทีเดียวมากเลยขอรับ ด้วยเหตุว่าทุกคนสามารถเข้าถึงสแกนคิวอาร์รหัสได้ สามารถสร้างคิวอาร์รหัสได้ด้วยตัวเอง และยังช่วยจัดการข้อมูลต่างๆของเราให้เรียบร้อยมากยิ่งขึ้นได้ ซึ่งทุกคนสามารถ

ใช้บริการ QR Code Generator ยกตัวอย่างเช่น qrcode.in.th ของเราได้เลยคะครับ

และก็อย่างที่ผมบอกไปใน EP.1 ว่า QR Code นั้นเข้ามาแทนที่การใช้ลิงก์ URL ที่ไม่สามารถตอบโจทย์ต่อการใช้

ในชีวิตประจำวันของเราได้ขนาดนั้น ในเรื่องที่พวกเราต้องการเข้าถึงข้อมูลต่างๆแน่นอนครับว่า ลิงก์ URL สามารถใช้ได้ แต่ว่าไม่ครอบคลุมทั้งผอง นั่นทำให้การใช้ QR Code การสแกนคิวอาร์โค้ด รวมทั้งการสร้างคิวอาร์โค้ดเป็นที่นิยมมากกว่านั่นเอง ยิ่งกว่านั้น ทางผู้สร้างคิวอาร์โค้ดหรือ QR Code ก็ยังปล่อยให้การใช้งาน QR Code นั้น ไม่ว่าใครก็สามารถใช้งานได้เลยด้วย ยิ่งทำให้การใช้ QR Code การสแกนคิวอาร์รหัส รวมถึงการผลิตคิวอาร์โค้ดมีอิสระมากขึ้นเรื่อยๆ QR Code Generator ที่ให้บริการสร้าง QR Code ก็มีมากขึ้นไปด้วยนั่นเองครับ

และก็สำหรับบทความในวันนี้ ผมก็จะมาเขียนถึงข้อดีของการใช้ QR Code กันต่อใน EP.2 นี้นะครับ เพื่อคุณได้เห็นจุดเด่นของการใช้ QR Code เพิ่มขึ้นเรื่อยๆ และคุณจะเจอเลยว่า QR Code มีดีมากกว่าที่คุณคิดอีกรอบ เอาละครับ เพื่อไม่ให้เป็นการเสียเวล่ำเวลา เรามาอ่านข้อดีที่เหลือไปพร้อมๆกันเลยครับผม

1. ช่วยปรับให้ธุรกิจต่างๆเติบโตมากเพิ่มขึ้น

1. ช่วยปรับให้ธุรกิจต่างๆเติบโตมากเพิ่มขึ้น

ผมได้บอกไปแล้วใน EP.1 ว่า เนื่องจากว่าทุกคนสามารถเข้าถึงการใช้งาน QR Code ได้ง่ายอย่างยิ่ง เพียงแต่คุณสแกนคิวอาร์รหัส คุณก็สามารถเข้าถึงข้อมูลต่างๆได้แล้ว มันก็เลยทำให้ไม่ว่าใครก็ตามที่มีโทรศัพท์มือถือแบบสมาร์ทโฟนสามารถ qr code generator

ใช้งาน QR Code ได้เลย ซึ่งนอกเหนือจากผู้ใช้งานจะได้ใช้ประโยชน์จากมันอย่างมาก เจ้าของกิจการต่างๆก็ได้รับผลประโยชน์ด้วยเช่นเดียวกัน เนื่องจากว่าการผลิต QR Code ด้วยบริการ QR Code Generator สแกนคิวอาร์โค้ด นั้นมีมากไม่น้อยเลยทีเดียวมากมายก่ายกอง qrcode.in.th ก็เหมือนกัน ทำให้การผลิตคิวอาร์รหัสนั้นเกิดเรื่องที่ง่าย แต่คุณประโยชน์พรั่งพร้อม เจ้าของกิจการสามารถโปรโมทร้าน โฆษณาโปรโมชั่นต่างๆหรือให้ความรู้ของตัวสินค้าหรือบริการของตนได้ไม่ยากผ่าน QR Code ได้เลยล่ะนะครับ มันก็ยิ่งทำให้ธุรกิจนั้นเติบโตเยอะขึ้น

ยิ่งไปกว่านี้ การสแกนคิวอาร์รหัสยังช่วยในเรื่องของการชำระเงินอีกด้วยนะครับ เนื่องจากว่าในปัจจุบัน แอพลิเคชันของธนาคารต่างๆนั้นล้วนแต่สามารถสแกนคิวอาร์โค้ดได้ ลูกค้าก็สามารถสแกนคิวอาร์โค้ดเพื่อจ่ายผลิตภัณฑ์หรือบริการนั้นๆได้ด้วยตัวเองเลยครับผม เรียกว่าทั้งยังง่าย สะดวก เร็วทันใจ รวมทั้งไม่มีอันตรายมากมายๆครับ

2. สามารถประยุกต์ใช้กับสื่อทุกประเภทได้ qr code generator

และก็อย่างที่ผมบอกไปใน EP.1 ว่า QR Code นั้นเข้ามาแทนที่การใช้ลิงก์ URL ที่ไม่สามารถตอบโจทย์ต่อการใช้

ในชีวิตประจำวันของพวกเราได้ขนาดนั้น ในเรื่องที่พวกเราต้องการเข้าถึงข้อมูลต่างๆแน่ๆครับผมว่า ลิงก์ URL สามารถใช้ได้ แม้กระนั้นไม่ครอบคลุมทั้งหมดทั้งปวงนั้น ก็เป็นเพราะสื่อต่างๆนั้นมีเยอะแยะมากมาย มิได้มีแค่เฉพาะออนไลน์เพียงแค่นั้น คุณลองคิดดูสื่อออฟไลน์ดังเช่น หนังสือพิมพ์ หนังสือ ป้ายที่ใช้สำหรับโฆษณาต่างๆถ้าหากพวกเราต้องการแชร์ข้อมูลแล้วจึงควรแนบลิงก์ URL ที่ยาวหรือเราบางครั้งอาจจะย่อลิงก์มาแล้ว แต่ว่าผู้ที่พบเห็นจำเป็นที่จะต้องนำไปพิมพ์อยู่ดี มันก็ไม่สะดวกใช่ไหมล่ะนะครับ ซึ่งเจ้า QR Code นี่แหละนะครับที่เข้ามาตอบปัญหาในส่วนนี้มากกว่า

เพียงแต่คุณสร้าง QR Code ขึ้นมา มันสามารถอยู่บนหนังสือพิมพ์ หนังสือ หรือป้ายที่ใช้โฆษณาต่างๆเมื่อไม่ว่าใครที่พบเห็นแล้วอยากเข้าถึงข้อมูล พวกเขาก็แค่ชูสมาร์ทโฟนขึ้นมาแล้วสแกนคิวอาร์รหัส เพียงเท่านี้ พวกเขาก็สามารถเข้าถึงข้อมูลได้แล้วครับผม โดยที่ไม่ต้องนั่งจำหรือถ่ายภาพลิงก์เอาไว้เพื่อนำไปพิมพ์อีกต่อหนึ่ง การใช้งาน QR Code จึงตอบโจทย์กับสื่อออนไลน์รวมทั้งออฟไลน์ทุกชนิดมากยิ่งกว่าครับผม

3. QR Code ไม่มีวันเก่า qr code generator

ที่ผมใช้คำว่า QR Code ไม่มีทางเก่า มันก็มีหลายความหมายแบบเดียวกันครับผม สิ่งแรกก็คือ เมื่อพวกเราสร้าง QR Code ขึ้นมาแล้ว มันจะคงอยู่ตลอดกาลขอรับ ไม่ว่าจะผ่านไปกี่ปี QR Code ก็จะสามารถใช้งานได้เสมอขอรับ ซึ่งถ้าเกิดใช้งานมิได้ มันจะเกิดขึ้นเพราะเหตุว่าตัวลิงก์หรือแหล่งข้อมูลของพวกเราหมดอายุนั่นเองนะครับ เรียกว่า QR Code ไม่มีวันหมดอายุกันอย่างยิ่งจริงๆ

และในความหมายลำดับที่สองของผมคือ QR Code จะเป็นส่วนหนึ่งส่วนใดในชีวิตประจำวันของเราไปอีกนานนมเลยครับ ถึงการวิจัยก่อนหน้านี้ที่ผ่านมา การใช้งาน QR Code จะไม่ได้ถึง 50% ของพลเมืองโลก แม้กระนั้นเชื่อเถอะครับว่า ตราบใดที่มันยังคงความง่าย ความสะดวกเร็ว แล้วก็ความสบายขนาดนี้ ในอนาคตมันก็จะเติบโตขึ้นเรื่อยๆอย่างแน่นอนครับผม

เป็นไงบ้างนะครับกับ ข้อดีของการใช้ QR Code EP.2 Qr code generator ผมก็หวังว่าทุกคนจะได้รับความรู้แล้วก็ประโยชน์ของ QR Code ครับผม ซึ่งหากใครสนใจต้องการสร้างคิวอาร์โค้ดด้วยตัวเองล่ะก็ บริการ QR Code Generator อย่าง qrcode.in.th พร้อมให้บริการทุกคนแบบฟรีๆเลยจ๊าครับ มาใช้งานกันจำนวนมากครับผม สำหรับวันนี้ ผมจะต้องขอตัวลาไปก่อน แล้วพบกันใหม่ในบทความหน้าครับ สวัสดีครับ

ติดต่อได้เร็วขึ้น qr code generator qrcode.in.th 14 มีนาคม 66 Margarette สแกนคิวอาร์โค้ดในคอม สร้าง qr codeนับคนสแกนได้ Top 8

ขอขอบคุณเว็บ สแกนคิวอาร์โค้ด

https://rebrand.ly/qrcode-in-th

บาคาร่าออนไลน์ sexybaccarat168.com 11 August 2565 บาคาร่าออนไลน์ casino สมัครบาคาร่าwebบาคาร่า 168 เล่นบาคาร่าออนไลน์ฟรี

บาคาร่าออนไลน์เว็บไหนดี บาคาร่า Sexybaccarat168.com 16 September 2565 บาคาร่าเว็บตรง บาคาร่าคือป๊อก 8 ป๊อก 9 ที่เมิงเคยเล่นนั่นแหละ คนนิยมเล่นบาคาร่าออนไลน์168 บาคาร่า888 และ บาคาร่า1688 กันเยอะ เพราะบาคาร่าออนไลน์ได้เงินจริง สำหรับผู้ที่กำลังมองหาเกมที่ทำการลงทุน บาคาร่าออนไลน์ ให้รับความระทึกใจ และก็ความเข้าใจสำหรับการใช้งานพวกเราขอกระทำการแนะนำเกมเซ็กซี่บาคาร่าให้เป็นตัวเลือกสำหรับการลงทุนของท่านเพราะว่าเก่ง เกมบาคาร่าถือได้ว่าเป็นเกมยอดฮิตที่ไม่ต้องลงทุนกระทำเลือกใช้งานกันมากที่สุด ด้วยเหตุว่าเป็นเกมซึ่งสามารถสร้างผลดังเช่นทุนได้จริง แล้วเดี๋ยวนี้ยังสามารถกระทำใช้งานผ่านเว็บไซต์ที่เปิดให้บริการได้ทำการเดินทางถือว่าเป็นการเข้าถึงที่สะดวกและก็รวดเร็วแม้คนไหนพอใจสามารถทำลงทะเบียนสมัครสมาชิกได้ตามเว็บไซต์ที่ท่านรู้สึกว่ามีความปลอดภัยแล้วก็เหมาะสมต่อการลงทุนของท่านสูงที่สุด

แม้พูดถึงเกมส์การลงทุนการเดิมพันที่อยู่ในหมวดหมู่ของคาสิโนแดนที่ได้รับความนิยมสูงที่สุดก็น่าจะเป็นเกมบาคาร่าสำหรับที่มาที่ไปของเกมบาคาร่านั้นเป็นความนิยมของ บาคาร่าซึ่งในช่วงเวลานี้สามารถกระทำการใช้งานผ่านระบบออนไลน์ได้ซึ่งนับว่าเราสามารถเข้าถึงการลงทุนได้ง่ายและสบายมากเพิ่มขึ้น เพราะว่าในอดีตนักลงทุนจะต้องกระทำเดินทางไปสถานที่ที่เปิดให้บริการแต่ในขณะนี้ทหารมีความต้องการทางการใช้งานก็เพียงแค่ทำการสมัครสมาชิกเพียงแต่ไม่ถึง 10 นาทีก็สามารถทำการใช้งานได้แล้วเพราะเหตุว่ากรรมวิธีการสมัครไม่ได้ยุ่งยากอย่างที่คิดเลยรวมทั้งที่มาที่ไปของเกมบาคาร่านั้นมีความนิยมและเป็นเกมเบิกบานที่ได้เริ่มมาจากประเทศอเมริกาตั้งแต่ปีคริสตศักราช 1914 ถึง 1922และก็บวกกับเป็นเกมส์ในลักษณะของการพนันก็เลยได้รับความนิยม เพิ่มมากขึ้นเรื่อยๆอย่างสม่ำเสมอ เพราะว่าเกมบาคาร่าที่เป็นเกมส์พนันนั้นสามารถสร้างรายได้ให้แก่นัมายากลงทุนได้จึงทำให้นักลงทุนนั้นนิยมกระทำใช้งานถ้าเกิดคนไหนพอใจจัดการการลงทุนและยังไม่เคยทราบว่าทำการลงทะเบียนสมัครสมาชิกของเว็บไหนหากสามารถกระทำลงทะเบียนสมัครสมาชิกของ เว็บคาสิโนออนไลน์ที่เปิดให้เล่นเกี่ยวกับเกมบาคาร่าได้ คาสิโนออนไลน์ sexy บาคาร่า ในรูปแบบใหม่ที่ฉีกกฎเดิมๆจากที่เคยเห็นมาก่อน การแจกไพ่โดยดีลเลอร์สาวสวยทั้งโลกมารวมไว้ที่นี่ สิ่งที่สมาชิกจะได้รับไม่ใช้เป็นเพียงอาหารตาแค่นั้น แต่ว่ายังมีความคมชัด ความแม่นยำของระบบที่ถูกสรรค์สร้างภายใต้คณะทำงานบริษัทผู้พัฒนาซอฟแวร์รวมทั้งทีมงานเกมมิ่งระดับนานาชาติมาคอยควบคุมระบบหลังบ้าน บาคาร่าออนไลน์ เกมส์ไพ่ยอดนิยมตลอดไปพร้อมเดิมพันไลฟ์สดสัมผัสประสบการณ์พนันเรียลไทม์มีลักษณะคล้ายกับการเล่นไพ่ป๊อกกระเด้ง ร่วมบันเทิงใจเล่นพนันได้ตลอดใช้บริการได้ตลอด ลุ้นรับโบนัสฟรี

สำหรับเว็บไซต์ บาคาร่า sexybaccarat168 www.sexybaccarat168.com อันดับ Top 634 Cleta ที่เปิดให้เล่นสำหรับบาคาร่าออนไลน์ก็มีนานัปการเว็บก็สามารถกระทำสำรวจดูได้ว่าพวกเรามีความต้องการทางการใช้งานเว็บไหนเว็บไหนที่มีหลักการสำหรับเพื่อการให้บริการซึ่งสามารถตอบโจทย์ความต้องการของพวกเราได้ หากว่าสามารถตอบโจทย์ในสิ่งที่ต้องการของพวกเราได้เป็นเว็บที่มีความปลอดภัยมีความน่าไว้วางใจสำหรับเพื่อการให้บริการก็สามารถดำเนินลำดับต่อไปก็คือกระบวนการลงทะเบียนสมัครสมาชิกเพื่อกระทำลงทุนต้นเหตุพื้นที่เว็บควรจะมีวิธีการลงทะเบียนเป็นสมาชิกซึ่งก็คือเพื่อปกป้องรักษาความปลอดภัยในการใช้งานของนักลงทุนแล้วก็ตัวของผมใช้เองรวมทั้งต้องการค่าสมาชิกที่จะกระทำการใช้งานจริงๆเพราะถ้ายังเป็นผู้เล่นที่ไม่มีประสบการณ์สำหรับเพื่อการใช้งานผ่านระบบออนไลน์จำต้องเรียนรู้ข้อมูลเพื่อเตรียมพร้อมสำหรับในการใช้งานรวมทั้งการใช้งานของท่านผ่านระบบออนไลน์จะได้มากเพิ่มขึ้นถึงแม้ท่านจะเป็นผู้เล่นมือใหม่ที่ยังไม่มีประสบการณ์สำหรับการลงทุนก็ตามแต่ท่านจะสามารถกระทำใช้งานไม่ให้กำเนิดข้อผิดพลาดได้อย่างแน่นอนเลือกหนทางสำหรับเพื่อการลงทุนและเราจะสามารถกระทำการลงทุนในช่องทางที่เราถนัดได้แต่ละวิถีทางในการลงทุนก็จะมีข้อดีข้อตำหนิในการใช้งานที่แตกต่างออกไปแม้กระนั้นสิ่งที่มีความสำคัญที่สุดซึ่งก็คือการเลือกผู้ให้บริการที่มีความปลอดภัยเพื่อการลงทุนที่มีโอกาสไปถึงเป้าหมายมากขึ้นเรื่อยๆสำหรับเพื่อการใช้งาน รวมปากทางเข้าเล่นpg slot auto ทดลองเล่นได้อย่างไม่ยากเย็นเพราะว่ามีทั้งยัง slot มือถือใหม่ล่าสุด สล็อตเว็บตรง 2021 แจกเครดิตฟรีไม่ยั้ง เว็บไซต์ใหม่เปิดใหม่พร้อม มีอีกทั้ง Pgslot999.com และ Pgslot77.com นอกจากนั้นยังมี เว็บไซต์สล็อตออนไลน์อีกเพียบเลย ตัวอย่างเช่น Joker123th.com, Allbet24hr.com, Slotxo24hr.com, Pussy888fun, Avenger98th.com, Hengjing168.com, Tangtem168.com, Alot666.com, Punpro66.com, Live22slot.com, Slotxoauto.com, 918kissauto.com, Joker123auto.com, เว็บบาคาร่า Sagame168th.com, Sexybaccarat168.com, Pussy888win.com, Pussy888play, Fullsloteiei.com เว็บที่ว่ามาทั้งสิ้นนี้ เป็นเว็บที่ลูกค้านักการพนันตัวจริงเชื่อถือ ว่าเมื่อผลกำไรแล้วสามารถถอนได้จริงๆไม่ปิดหนี เพราะเป็นเว็บตรงที่แจกจริง อะไรจริง บาคาร่าเว็บไหนดี สมัครบาคาร่า168 บาคาร่าเว็บตรงจะต้องน่ามองบาคาร่า168 เว็บไซต์บาคาร่า ชั้น1 ไม่ต้องหาตรงไหนไกล สามารถเล่นผ่านเว็บได้เลยที่นี่ บาคาร่าออนไลน์ ได้เงินจริง เล่นง่ายๆเพียงแต่เล่นที่เว็บบาคาร่า อย่างต่ำ 1 บาท แค่นั้น

casino online บาคาร่าออนไลน์ ในรูปแบบใหม่ที่ฉีกกฎเดิมๆจากที่เคยได้เห็นมาก่อน การแจกไพ่โดยดีลเลอร์สาวสวยทั่วทั้งโลกมารวมไว้ที่นี่ สิ่งที่สมาชิกจะได้รับไม่ใช้เป็นเพียงแต่อาหารตาเท่านั้น แม้กระนั้นยังมีความแหลมคมชัด ความเที่ยงตรงของระบบที่ถูกสรรค์สร้างภายใต้คณะทำงานบริษัทผู้พัฒนาซอฟแวร์และคณะทำงานเกมมิ่งสุดยอดมาคอยควบคุมระบบหลังบ้าน พวกเราเป็นผู้ให้บริการบาคาร่าออนไลน์แบบเรียลไทม์ ส่งตรงจากบ่อน Casino ผู้เล่นสามารถดูไพ่ที่แจก ก่อนเริ่มเดิมพันได้ในเวลา 20-30 วินาที Baccarat Online เป็นเกมส์ที่มีเสน่ห์ มีนักพนันเล่นกันเยอะๆ ผู้เล่นยังสามารถรับเงินรางวัลจากเกมส์ไปได้ ภายในช่วงเวลาไม่กี่วินาทีก่อนที่เกมส์การประลองจะจบลงอีกด้วย และก็ผู้เล่นจะได้รับประสบการณ์ การเล่นคาสิโนออนไลน์ที่ปลอดภัย โดยมีระบบระเบียบตรวจทานที่ได้รับการยินยอมรับในระดับสากล สมัครเล่นบาคาร่ากับ SexyAuto168 รับโบนัสแรกเข้าในทันที และลุ้นรับโบนัสอีกมากมายกับโปรโมชั่นรอบเดือน พอใจเล่นบาคาร่ากับพวกเราติดต่อพวกเราได้ตลอด 24 ช.มัธยม เมื่อท่านให้ความสนใจต้องการทำการเล่นเกมบาคาร่า บาคาร่าออนไลน์ สำหรับเกมบาคาร่าเป็นรูปแบบของเกมคาสิโนก็จำเป็นต้องกระทำลงทะเบียนสมัครสมาชิก บาคาร่า หรือกระทำการเดินทางไปยังสถานที่ที่เปิดให้บริการท่านก็สามารถกระทำใช้งานและสามารถทำการลงทุนได้ เลือกช่องทางใดมา 1 ช่องทางรวมทั้งเลือกผู้ให้บริการที่มีความปลอดภัยสูงที่สุด เมื่อเรามีผู้ให้บริการที่มีความปลอดภัยเยอะที่สุดการลงทุนของพวกเราก็จะมีความปลอดภัยและก็มีโอกาสไปถึงเป้าหมายในการเล่นนั้นเอง หลักเกณฑ์ในการเลือกเว็บไซต์สำหรับการลงทุนหรือการใช้แรงงานเกี่ยวกับการทำงานเรารู้ดีว่าการพนันมีการเสี่ยงในว่าเกมนั้นท่านจะมีความชำนาญสำหรับในการใช้งานมากน้อยแค่ไหนแต่ว่าต้องการสำหรับในการลงทุนย่อมมีความเสี่ยงอยู่ดีด้วยเหตุนั้นถ้าท่านให้ความสนใจกับการใช้แรงงานจริงๆก็ต้องกระทำสำรวจข้อมูลและศึกษาเนื้อหาเพื่อเลือกสิ่งที่เยี่ยมที่สุดให้แก่การลงทุนของตนยิ่งเรามีแบบลงทุนที่ดีแล้วก็มีคุณภาพมากเท่าไหร่ การลงทุนของพวกเราก็จะได้โอกาสประสบผลสำเร็จได้รับกำไรคืนมาตามความอยากได้ของพวกเรามากมายเท่านั้นด้วยเหตุนี้หากใครกันแน่พึงพอใจทำใช้บริการก็สามารถกระทำการสมัครสมาชิกของเว็บที่ดีได้หรือทำการสอบถามจากคนที่มีประสบการณ์สำหรับในการเล่นมาก่อนก็ได้เพื่อเขากระทำการแนะนำว่าเว็บไซต์ที่ดีควรจะมีลักษณะอย่างไร ฉะนั้นหากคนใดกันแน่ที่ได้เว็บตรงนี้แล้วหลังจากนั้นก็กระทำการลงทะเบียนเป็นสมาชิกถ้าเกิดไม่เคยกระทำการสมัครสมาชิกพวกเราสามารถมองได้จากแนวทางการใช้งานของทางเว็บไซต์ผู้ให้บริการนั้น ก็จะมีการแนะนำการใช้แรงงานให้พวกเรากระทำเลือกรวมทั้งทำลงทุนและมั่งมีเพิ่มขึ้นเรื่อยๆนั่นเอง แต่ว่าเมื่อกระทำลงทะเบียนเป็นสมาชิก บาคาร่าออนไลน์ เป็นระเบียบเรียบร้อยแล้วหลังจากนั้นก็สามารถเข้าใช้งานก็เข้าไปหมู่คำว่าคาสิโนแล้วก็เลือกกเล่นเกมบาคาร่าหรือ บาคาร่า168 ที่ท่านต้องการท่านก็สามารถทำลงทุนและก็สามารถทำใช้งานได้แล้วเพียงเท่านี้ท่านก็สามารถกระทำลงทุนและอย่าลืมว่าการมีสติและก็ช่วยพวกเราได้รับผลกำไรกลับมาง่ายดายมากยิ่งขึ้นบากบั่นมีสติสำหรับการเล่นแล้วก็การลงทุนทุกคราวและผลที่ได้จะได้ผลสำเร็จลัพธ์ที่ดีอย่างแน่แท้

casino online บาคาร่าออนไลน์ ในรูปแบบใหม่ที่ฉีกกฎเดิมๆจากที่เคยได้เห็นมาก่อน การแจกไพ่โดยดีลเลอร์สาวสวยทั่วทั้งโลกมารวมไว้ที่นี่ สิ่งที่สมาชิกจะได้รับไม่ใช้เป็นเพียงแต่อาหารตาเท่านั้น แม้กระนั้นยังมีความแหลมคมชัด ความเที่ยงตรงของระบบที่ถูกสรรค์สร้างภายใต้คณะทำงานบริษัทผู้พัฒนาซอฟแวร์และคณะทำงานเกมมิ่งสุดยอดมาคอยควบคุมระบบหลังบ้าน พวกเราเป็นผู้ให้บริการบาคาร่าออนไลน์แบบเรียลไทม์ ส่งตรงจากบ่อน Casino ผู้เล่นสามารถดูไพ่ที่แจก ก่อนเริ่มเดิมพันได้ในเวลา 20-30 วินาที Baccarat Online เป็นเกมส์ที่มีเสน่ห์ มีนักพนันเล่นกันเยอะๆ ผู้เล่นยังสามารถรับเงินรางวัลจากเกมส์ไปได้ ภายในช่วงเวลาไม่กี่วินาทีก่อนที่เกมส์การประลองจะจบลงอีกด้วย และก็ผู้เล่นจะได้รับประสบการณ์ การเล่นคาสิโนออนไลน์ที่ปลอดภัย โดยมีระบบระเบียบตรวจทานที่ได้รับการยินยอมรับในระดับสากล สมัครเล่นบาคาร่ากับ SexyAuto168 รับโบนัสแรกเข้าในทันที และลุ้นรับโบนัสอีกมากมายกับโปรโมชั่นรอบเดือน พอใจเล่นบาคาร่ากับพวกเราติดต่อพวกเราได้ตลอด 24 ช.มัธยม เมื่อท่านให้ความสนใจต้องการทำการเล่นเกมบาคาร่า บาคาร่าออนไลน์ สำหรับเกมบาคาร่าเป็นรูปแบบของเกมคาสิโนก็จำเป็นต้องกระทำลงทะเบียนสมัครสมาชิก บาคาร่า หรือกระทำการเดินทางไปยังสถานที่ที่เปิดให้บริการท่านก็สามารถกระทำใช้งานและสามารถทำการลงทุนได้ เลือกช่องทางใดมา 1 ช่องทางรวมทั้งเลือกผู้ให้บริการที่มีความปลอดภัยสูงที่สุด เมื่อเรามีผู้ให้บริการที่มีความปลอดภัยเยอะที่สุดการลงทุนของพวกเราก็จะมีความปลอดภัยและก็มีโอกาสไปถึงเป้าหมายในการเล่นนั้นเอง หลักเกณฑ์ในการเลือกเว็บไซต์สำหรับการลงทุนหรือการใช้แรงงานเกี่ยวกับการทำงานเรารู้ดีว่าการพนันมีการเสี่ยงในว่าเกมนั้นท่านจะมีความชำนาญสำหรับในการใช้งานมากน้อยแค่ไหนแต่ว่าต้องการสำหรับในการลงทุนย่อมมีความเสี่ยงอยู่ดีด้วยเหตุนั้นถ้าท่านให้ความสนใจกับการใช้แรงงานจริงๆก็ต้องกระทำสำรวจข้อมูลและศึกษาเนื้อหาเพื่อเลือกสิ่งที่เยี่ยมที่สุดให้แก่การลงทุนของตนยิ่งเรามีแบบลงทุนที่ดีแล้วก็มีคุณภาพมากเท่าไหร่ การลงทุนของพวกเราก็จะได้โอกาสประสบผลสำเร็จได้รับกำไรคืนมาตามความอยากได้ของพวกเรามากมายเท่านั้นด้วยเหตุนี้หากใครกันแน่พึงพอใจทำใช้บริการก็สามารถกระทำการสมัครสมาชิกของเว็บที่ดีได้หรือทำการสอบถามจากคนที่มีประสบการณ์สำหรับในการเล่นมาก่อนก็ได้เพื่อเขากระทำการแนะนำว่าเว็บไซต์ที่ดีควรจะมีลักษณะอย่างไร ฉะนั้นหากคนใดกันแน่ที่ได้เว็บตรงนี้แล้วหลังจากนั้นก็กระทำการลงทะเบียนเป็นสมาชิกถ้าเกิดไม่เคยกระทำการสมัครสมาชิกพวกเราสามารถมองได้จากแนวทางการใช้งานของทางเว็บไซต์ผู้ให้บริการนั้น ก็จะมีการแนะนำการใช้แรงงานให้พวกเรากระทำเลือกรวมทั้งทำลงทุนและมั่งมีเพิ่มขึ้นเรื่อยๆนั่นเอง แต่ว่าเมื่อกระทำลงทะเบียนเป็นสมาชิก บาคาร่าออนไลน์ เป็นระเบียบเรียบร้อยแล้วหลังจากนั้นก็สามารถเข้าใช้งานก็เข้าไปหมู่คำว่าคาสิโนแล้วก็เลือกกเล่นเกมบาคาร่าหรือ บาคาร่า168 ที่ท่านต้องการท่านก็สามารถทำลงทุนและก็สามารถทำใช้งานได้แล้วเพียงเท่านี้ท่านก็สามารถกระทำลงทุนและอย่าลืมว่าการมีสติและก็ช่วยพวกเราได้รับผลกำไรกลับมาง่ายดายมากยิ่งขึ้นบากบั่นมีสติสำหรับการเล่นแล้วก็การลงทุนทุกคราวและผลที่ได้จะได้ผลสำเร็จลัพธ์ที่ดีอย่างแน่แท้

การตลาดออนไลน์หลักๆที่นิยมทำกัน ก็คือ เฟส แอด, กูเกิ้ล แอด รวมทั้งในขณะนี้มี Tiktok Ads เข้ามาด้วย ห้ามพลาดที่จะเรียนรู้

ทำ SEO

การตลาดที่สำคัญสำหรับหาลูกค้าที่จะมาเล่น สมัครบาคาร่า กับเรา ที่แนะนำเลย เป็นแนวทางการทำ SEO

แม้สนใจอยากเล่นเกมส์สนุกสนานๆที่ได้เงินจริง จำต้องเล่นที่นี่ sexybaccarat168.com

Reference เว็บบาคาร่า https://www.sexybaccarat168.com/ https://www.sexybaccarat168.com/

ทางเข้าสล็อต168 pgสล็อต168ทางเข้าสล็อต เกมส์สล็อตมือถือสล็อตเว็บหลัก สล็อตออนไลน์ ในเว็บเดียว Top 28 by Maddison m.hengjing168.win 10 February 2023

4 เคล็ดลับพาโชคดีจริง! สล็อตคาสิโน

สวัสดีครับชาว m.hengjing168.win สล็อต168 ทุกท่าน ขณะนี้เป็นไงบ้างนะครับ? ผมบอกเลยว่า ช่วงนี้เว้นแต่เรื่องสล็อตออนไลน์ที่ผมสนใจเป็นพิเศษอยู่แล้ว ผมกำลังพึงพอใจเรื่องของสภาพอากาศครับ หนาวมากมาย! ในเวลาที่ผมเขียนบทความนี้อยู่ เชื่อไหมขอรับว่าผมใส่เสื้อตั้ง 2 ตัวเลยคะครับ แล้วนี่มกราคมครับ! เว้นเสียแต่อากาศผันแปรแล้ว ฝุ่นก็มากมายด้วย ทุกคนก็ดูแลรักษาสุขภาพร่างกายกันด้วยครับผม นอนเล่น 168สล็อต กันชิวๆอยู่บ้านดีมากยิ่งกว่าออกไปภายนอกบ้านครับเวลานี้ ฮ่า… สล็อต168

เอาละนะครับ สำหรับบทความในวันนี้ ผมก็อยากจะมาแชร์ 5 เทคนิคพาโชคดีจริงต้นแบบของผมรวมทั้งเพื่อนรักที่ผมบอกเลยว่า ไม่ว่าคุณจะเล่นสล็อตออนไลน์ของค่ายเกมไหน สล็อต168 168สล็อต หรือใดๆก็ตามแต่ คุณก็สามารถนำวิธีนี้ไปใช้ได้จริงๆเลยครับ ผมยืนยันว่า หากคุณสามารถทำตามได้ครบอีกทั้ง 4 เทคนิคนี้ล่ะก็ มันจะช่วยทำให้คุณเล่นได้มากขึ้นแบบ

ไม่รู้ตัวเลยล่ะครับผม

แล้วก็เพื่อไม่ให้เป็นการเสียเวลาครับ เรามาดูไปพร้อมเพียงกันเลยว่า 4 เคล็ดลับพาเฮงจริงฉบับของผมและก็เพื่อนรัก

จะเป็นยังไง มีเทคนิคสำคัญอะไรบ้าง ถ้าเกิดคุณพร้อมแล้วหลังจากนั้นก็มาดูไปพร้อมเพียงกันเลยครับผม เลทโก!

1. เลือกเว็บไซต์สล็อตออนไลน์ที่เป็นสล็อตเว็บไซต์ตรงเพียงแค่นั้น สล็อต168

นี่คือสิ่งที่ผมแล้วก็เพื่อนรักพร่ำบอกสหายๆหรือใครก็ตามที่กำลังริเริ่มจะเล่นสล็อตออนไลน์อยู่ตลอดเลยขอรับ การเลือกเว็บไซต์สล็อต168 ดีๆสักเว็บเป็นเรื่องที่ไม่ยากเลยขอรับ สิ่งแรกที่คุณจำต้องมองเลยก็คือ เว็บ168สล็อตที่คุณเลือกนั้นเป็นสล็อตออนไลน์เว็บไซต์ตรงรึเปล่า แล้วคุณจะรู้ได้เช่นไร? ตอนแรกเลย ผมต้องอธิยานก่อนว่า สล็อตออนไลน์เว็บไซต์ตรงคืออะไร สล็อตออนไลน์เว็บตรงก็คือ เว็บสล็อต168ที่ผู้ให้บริการเว็บไซต์นั้นได้ทำการขอใบสุทธิจากค่ายเกม168สล็อตหรือค่ายต่างๆเป็นระเบียบ ต่างจากเว็บเอเย่นต์ที่จะมิได้จัดการขอ ทางเข้าสล็อต168 ซึ่งมันทำให้การเล่นสล็อตออนไลน์เว็บตรงปลอดภัยมากยิ่งกว่า มีความน่าไว้ใจมากกว่า รวมทั้งฐานคนเล่นมากกว่าด้วยเช่นเดียวกัน ซึ่งมันก็นำมาซึ่งการทำให้คุณสามารถเล่นได้ตามจังหวะแล้วก็ดวงของคุณอย่างแท้จริง ต่างจากเว็บไซต์เอเย่นต์โดยสิ้นเชิง ฉะนั้น ถ้าหากอยากจะพาโชคดีล่ะก็ เลือกเว็บไซต์สล็อตออนไลน์ให้ถูกด้วยครับ แม้กระนั้นหากเลือกไม่ได้ก็มาเล่นที่ m.hengjing168.win กันครับผม

2. หาผลประโยชน์จากโปรโมชั่นให้ได้มากที่สุด สล็อต